This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

EXIM India, BOC Aviation, Clifford, Hyundai Capital Launch $ Bonds

January 5, 2026

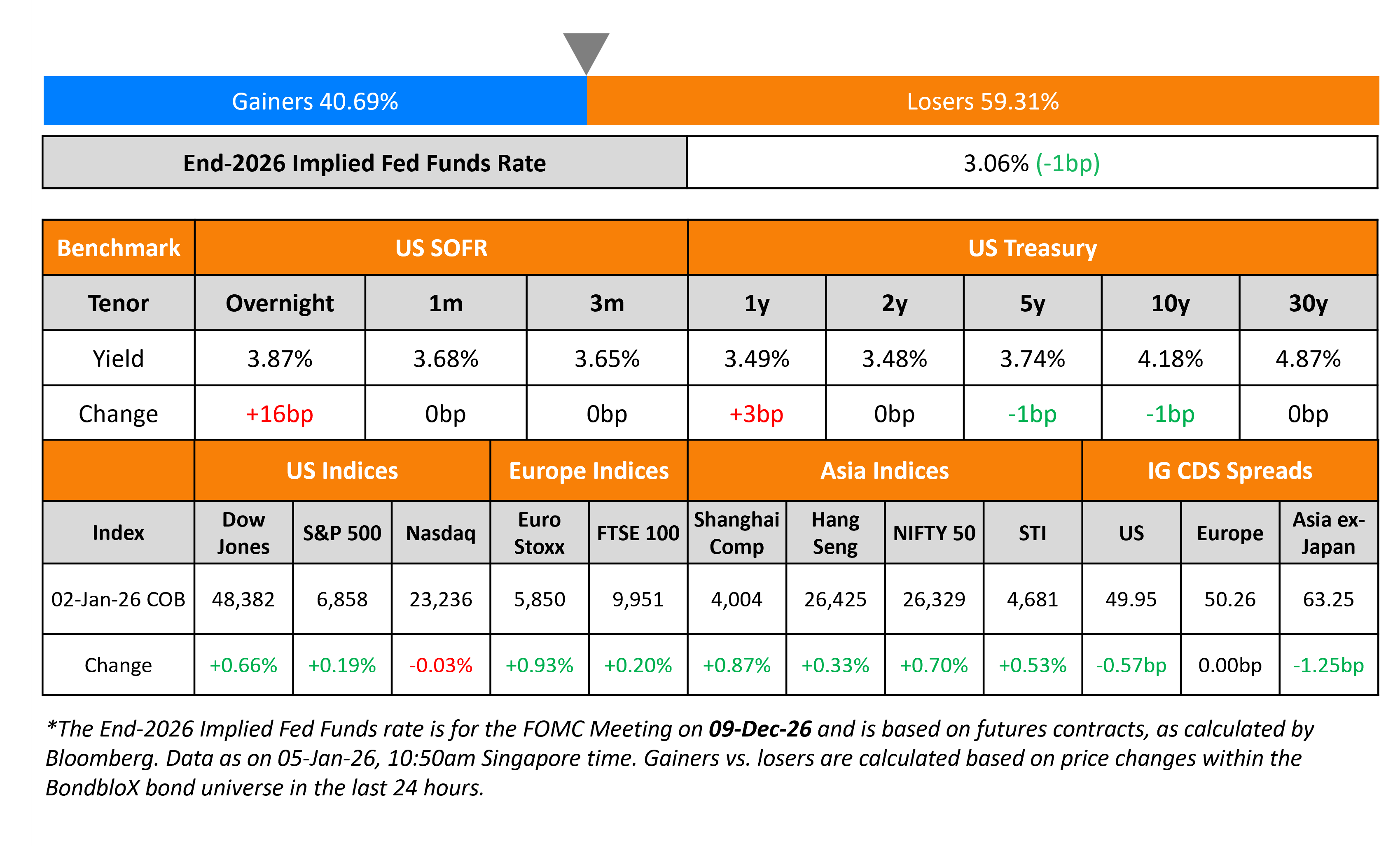

US Treasury yields were broadly stable across the curve. This week will see a flurry of key data points including the ISM readings and the payrolls report. To recap the macro developments over the past week, the FOMC’s December meeting minutes showed some internal disagreements on future policy. Some officials argued that the current policy stance is essentially close to neutral, and further cuts may not be needed immediately. However, some indicated that further downward rate adjustments could be appropriate if inflation continued to decline and labor market weakness persisted. The committee stated that future decisions will be informed by a broad range of incoming data, and not just inflation or jobs figures alone.

Looking at US equity markets, the S&P ended 0.2% higher while the Nasdaq closed flat on Friday. US IG CDS spreads tightened by 0.6bp while HY CDS spreads were wider by 0.8bp. European equity indices ended higher. The iTraxx Main CDS spreads flat while the Crossover CDS spreads were 0.5bp tighter. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads tightened 1.3bp.

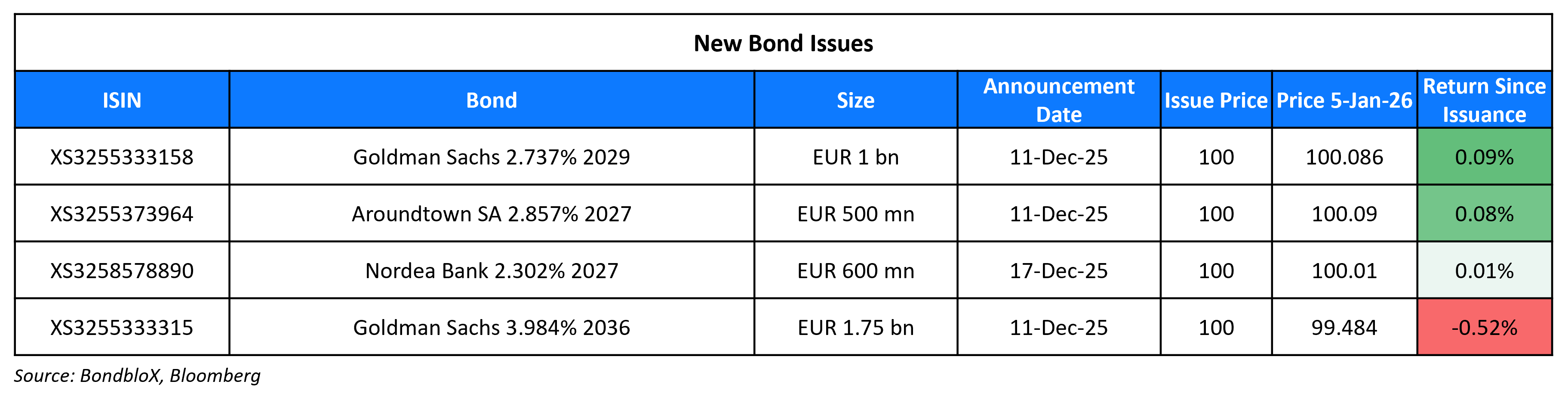

New Bond Issues

- EXIM India $ 10Y/30Y at T+115/140bp area

- BOC Aviation $ 7Y at T+95bp area

- Hyundai Capital $ 3Y/3Y FRN/5Y/5Y FRN/7Y at T+105/SOFR eq/T+115/SOFR eq/T+125bp areas

-

SMFG $ 3Y/3Y FRN/6NC5/6NC5 FRN/11NC10/21NC20 at T+87.5/SOFR eq/T+110/SOFR eq/T+120/T+110bp areas

-

MUFG $ 6NC5/6NC5FRN/11NC10 at T+105-110/SOFR eq/T+120bp areas

Rating Changes

- Fitch Upgrades Volcan IDRs to ‘B’; Outlook Positive

- Fitch Upgrades Medline to ‘BBB-‘; Outlook Stable

- Fitch Downgrades Braskem’s IDR to ‘CC’

- Moody’s Ratings downgrades China Vanke’s ratings to Ca/C; outlook remains negative

- Fitch Rates Rolls-Royce Holdings plc ‘BBB+’; Outlook Positive

New Bonds Pipeline

- Clifford Capital $ 3Y/5Y bond

- Swire Properties $ 5Y bond

- KEXIM $ 3Y/3Y FRN/5Y/10Y bonds

Term of the Day: Haircut

Haircut refers to a reduction in value of an asset for the purpose of calculating either margin requirements, level of collateral or salvage value. The haircut is generally stated as a percentage and is the difference between the value of the asset and its reduced value. For example, in a restructuring, if a bond worth $100mn faces a haircut of 20%, then holders would receive only $80mn. In the case of a loan, if the collateral is worth $100mn, a haircut of 30% would imply that a loan of $70mn, giving the lender a cushion in case the market value of the collateral falls.

Talking Heads

On Dollar Posting Worst Year Since 2017 With More Fed Cuts Expected

Yusuke Miyairi, Nomura

“The biggest factor for the dollar in first quarter will be the Fed”

Andrew Hazlett, Monex

“Hassett would be more or less priced in since he has been the frontrunner… Warsh or Waller would likely not be as quick to cut, which would be better for the dollar”

On Stocks Closing Out Third Year of Gains

Adam Turnquist, LPL Financial

“Describing 2025 as ‘resilient’ might be an understatement… economy showed remarkable strength by overcoming higher inflation, a slowing labor market”

Brendan Fagan, Bloomberg

“2025 was the year when diversification finally paid off. Equities delivered… metals took the crown on erosion of confidence and a repricing of policy risk”

On Global Retreat From EM Bonds May Be Boon for 2026

Didier Lambert, JP Morgan Asset Management

The relative decline in foreign ownership is “one of the main reasons we are bullish on this asset class”… prefers local-currency debt from emerging economies with “large and deep local pockets, which allows them to stem volatility, such as Mexico, South Africa, Brazil, India and Thailand”

Philip Fielding, Fidelity International

“Local buyers of bonds are usually not exposed to currency risk and tend to be more strategic, long-term holders”

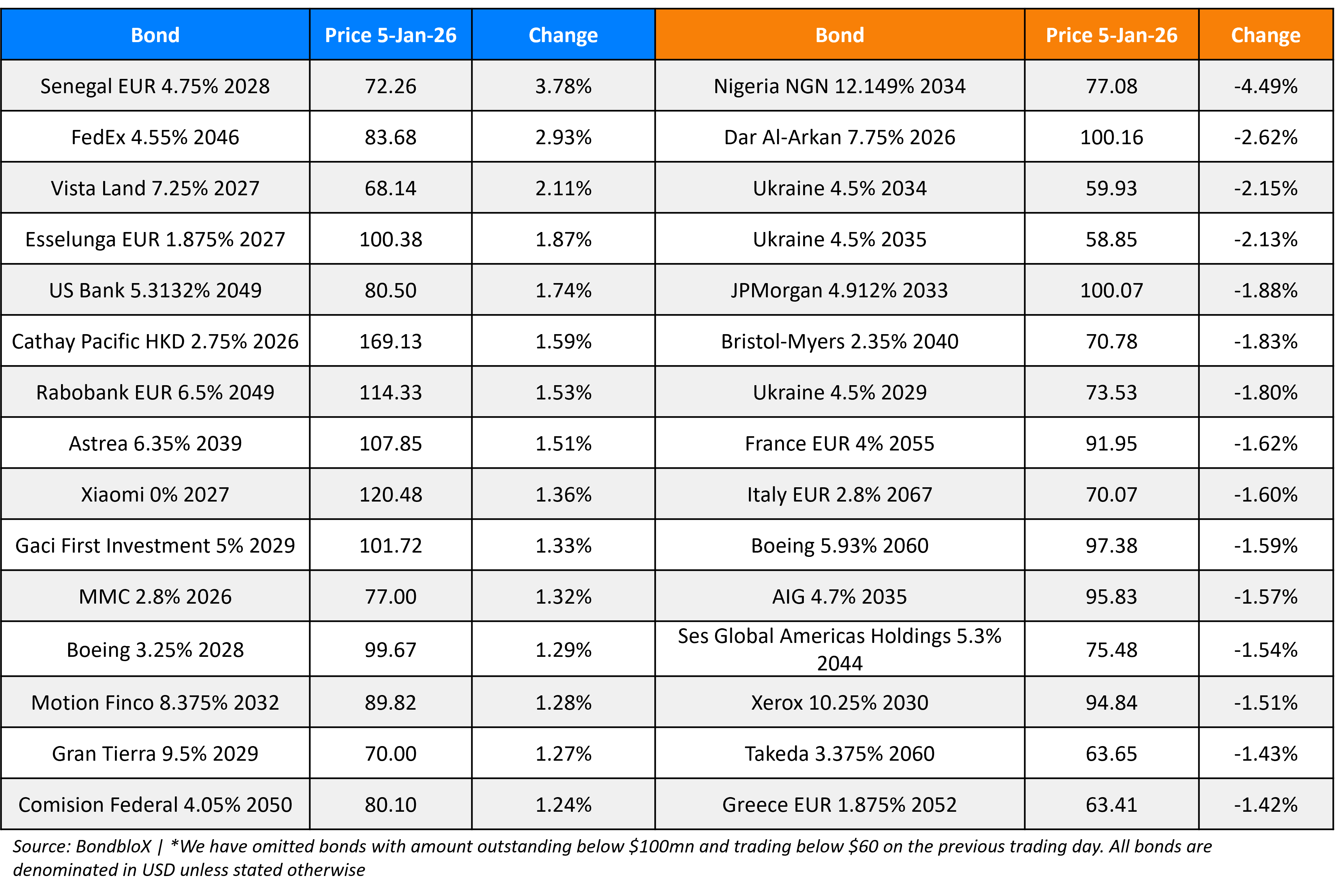

Top Gainers and Losers- 05-Jan-26*

Go back to Latest bond Market News

Related Posts: