This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ECB Keeps Rates Unchanged, Opens Door for September

July 19, 2024

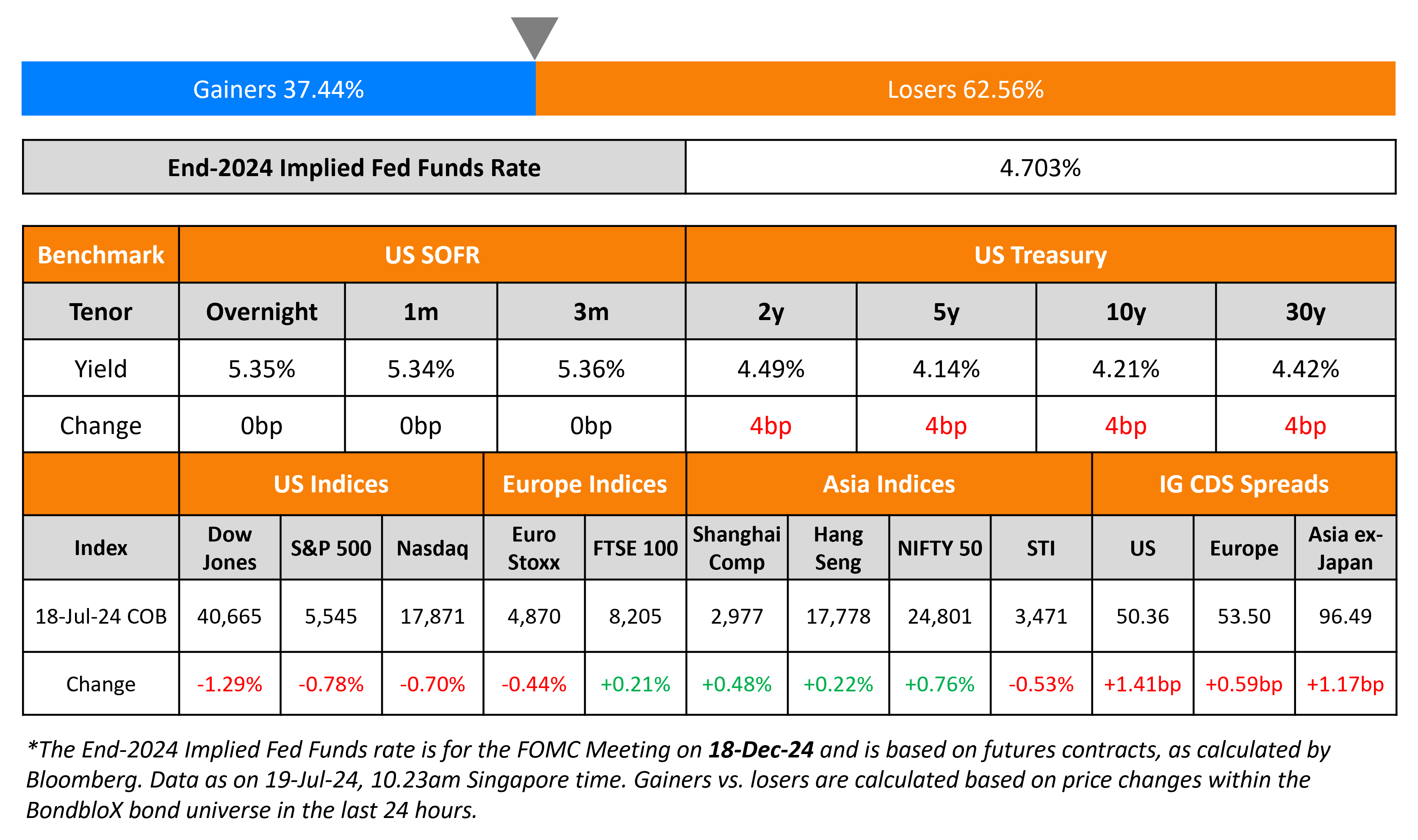

The US Treasury curve saw a parallel shift higher in yields, by 4bp across the curve on Thursday. Chicago Fed President Austan Goolsbee said that the Fed may need to lower rates soon in order to avoid a sharper deterioration in the labor market. He added that multiple months of improving data have reassured him that they are on track to bring inflation down to their 2% goal. Equity indices continued to move lower, with the S&P and Nasdaq falling 0.7-0.8%. US IG spreads were 1.4bp wider and HY CDS spreads were wider by 6.2bp.

European equity indices ended mixed. In credit markets, the iTraxx Main and Crossover spreads were wider by 0.6bp and 1.8bp respectively. The ECB kept its policy rates unchanged with the ECB President Christine Lagarde noting that September’s meeting was “wide open” for a rate cut. Asian equity indices have opened in the red this morning. Asia ex-Japan CDS spreads were 1.2bp wider.

New Bond Issues

Hong Kong raised $1bn via a 3Y green bond at a yield of 4.34%, 28bp inside initial guidance of T+40bp area. The bonds are rated AA+/AA-. Proceeds will be used to finance and/or refinance projects that fall under one or more of eligible categories under its Green Bond Framework.

Masdar raised $1bn via a two-part deal. It raised $500mn via a 5Y bond at a yield of 5.036%, ~37.5bp inside initial guidance of T+130/135bp area. It also raised $500mn via a 10Y bond at a yield of 5.319%, ~27.5bp inside initial guidance of T+140/145bp area. The senior unsecured bonds are rated A2/AA- (Moody’s/Fitch). Proceeds will be used to finance and/or refinance projects that fall under one or more of eligible categories under its Green Bond Framework.

Rating Changes

- Ukrainian Electricity Producer DTEK Renewables Rating Lowered To ‘SD’ After Distressed Debt Exchange

- Fitch Downgrades China Huanong Property & Casualty’s IFS Rating to ‘BBB-‘; Outlook Negative

- Shanghai Electric Holdings, Subsidiary Outlook Revised To Stable On Steady Financial Prospects; ‘BBB’ Ratings Affirmed

- Moody’s Ratings affirms IndusInd’s Ba1 ratings, upgrades standalone credit profile

- Cleveland-Cliffs Inc.’s Outlook Revised To Stable On Proposed Acquisition; ‘BB-‘ Rating Affirmed

Term of the Day

Payment-in-kind (PIK)

Payment-in-kind (PIK) is a type of bond for which, on each coupon payment date, the accrued coupon is capitalized and fully or partially paid in the form of additional bonds or added to the principal amount. PIK bonds are typically bonds with deferred coupons. These are riskier for investors due to more credit risk with respect to the PIK interest amount, payment of which can be deferred until maturity. Given this inherent higher risk, interest rates for PIK bonds are higher than for conventional bonds. Generally, issuers with liquidity stresses that are able to pay coupons in non-cash form issue these notes.

Talking Heads

On India Must Lower Inflation to Sustain Growth – RBI

“Given the high uncertainty shrouding the inflation outlook, it is prudent to eschew the temptation of time inconsistency and stay the course on the straight and narrow path of aligning inflation with the target of 4%”

On BOJ wanting to maintain accommodative monetary policy – Chief Cabinet Secy Yoshimasa Hayashi

“We expect the Bank of Japan to continue working closely with the government and, with an eye on economic, price and monetary conditions, to conduct its monetary policy appropriately toward achieving 2% price target sustainably and stably”

On Private Credit Pushing Deeper Into Risk

Tim Donahue, Lazard

“An absence of rate cuts from the Fed is starting to impact businesses who knew they would have to refinance and were hoping rate cuts would be a tail wind”

Top Gainers & Losers- 19-July-24*

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Unifin Downgraded to BB- by Fitch

April 7, 2022

.png)