This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

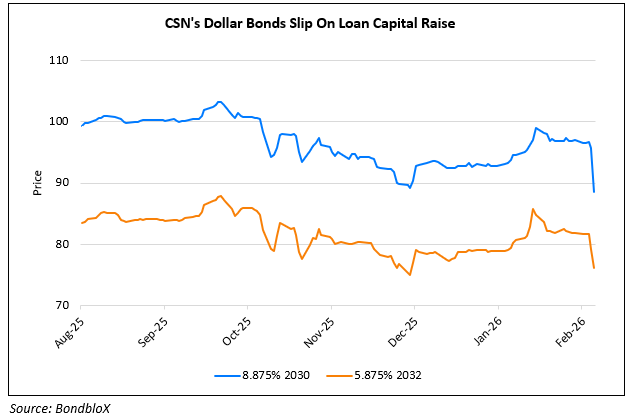

Dollar Bonds of Brazil’s CSN and Raizen Drop Sharply

February 6, 2026

CSN’s dollar bonds slipped by 1-3 points across the curve. The company was said to be planning to raise up to $1.5bn through a secured loan to refinance maturing bonds and improve its debt profile, as per sources. The financing would be backed by shares in CSN subsidiaries, including its cement unit. The fundraising plan comes amid the pressure of high interest rates on its already heavily leveraged balance sheet and investment capacity. CSN said last month that it intends to divest assets to cut debt, setting a target of BRL 15–18bn ($2.9–3.4bn), roughly half its total debt, starting this year. CSN has also hired advisers to sell a significant stake in CSN Infraestrutura and control of its cement business, while also seeking a strategic partner to modernize its core steel operations.

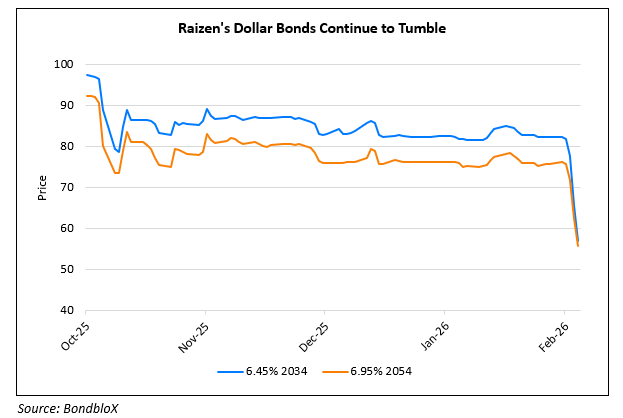

Separately, bonds of another Brazilian corporate, Raizen, continued to tumble by another 6-8 points amid rising fears that its two main shareholders, Cosan and Shell, may not cover an estimated $4bn funding gap.

Go back to Latest bond Market News

Related Posts:

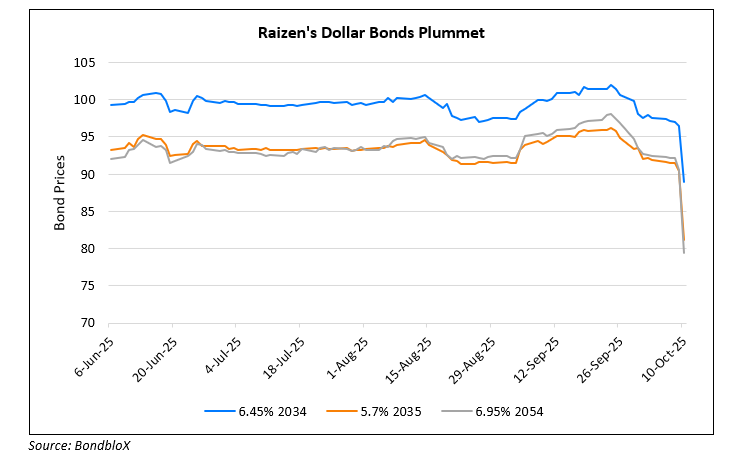

Raizen’s Dollar Bonds Drop Sharply

October 10, 2025

CSN Downgraded to BB- by Fitch

February 4, 2026