This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

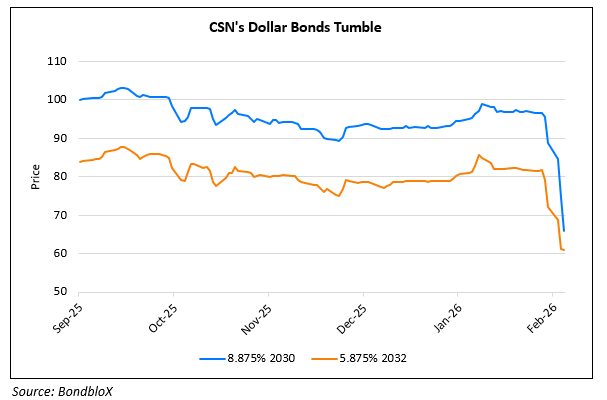

CSN’s Dollar Bonds Tumble; Lose ~25% in a Week

February 11, 2026

Dollar bonds of Brazilian steelmaker Cia Siderurgica Nacional (CSN) tumbled by 5-8 points across the curve. The move came as Brazil’s corporate debt market was shaken by a sharp sell-off following the dramatic credit downgrades of Raizen. Analysts note that the moves have hurt investors’ confidence in highly leveraged issuers. Raizen’s ratings were cut seven to eight notches in one day by S&P and Fitch. Fund managers warned such sudden downgrades suggest Brazilian corporate risk premiums may be underpriced. Earlier last week, CSN had announced a major divestment plan aimed at debt reduction and a potential $1.5bn secured loan refinancing. CSN was downgraded to B+ and BB- by S&P and Fitch respectively in the past few weeks. CSN’s bonds have lost ~25% in a week, as seen in the chart above.

Go back to Latest bond Market News

Related Posts: