This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CSN Announces Divestment Plan to Reduce Debt

January 16, 2026

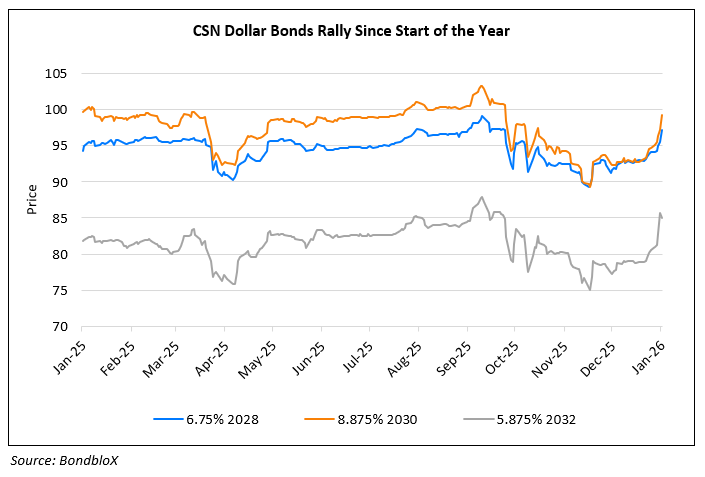

Brazilian steelmaker, Companhia Siderúrgica Nacional (CSN) announced a major divestment plan aimed at decisively fixing its capital structure by reducing debt. The company plans to deleverage BRL 15–18bn (~$2.8–3.3bn) via asset sales, including selling control of its cement unit and a significant stake in its infrastructure business that owns rail and port assets. The strategy supports CSN’s longer-term goal of doubling core earnings over eight years and cutting leverage from 3.14x net debt/EBITDA (Q3 2025) to 1.0x over the same period. The management emphasized that debt reduction is the top priority, not asset quality concerns, while also exploring partnerships to improve cash generation in its steel business. Analysts at JPMorgan viewed the plan positively but cautioned that execution will be critical. CSN confirmed its mining division is not for sale. In addition the company does not intend to sell any additional stakes of its iron ore unit, CSN Mineracao. CSN’s dollar bonds have been trending higher since start of the year as seen in the chart

For more details, click here

Go back to Latest bond Market News

Related Posts: