This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

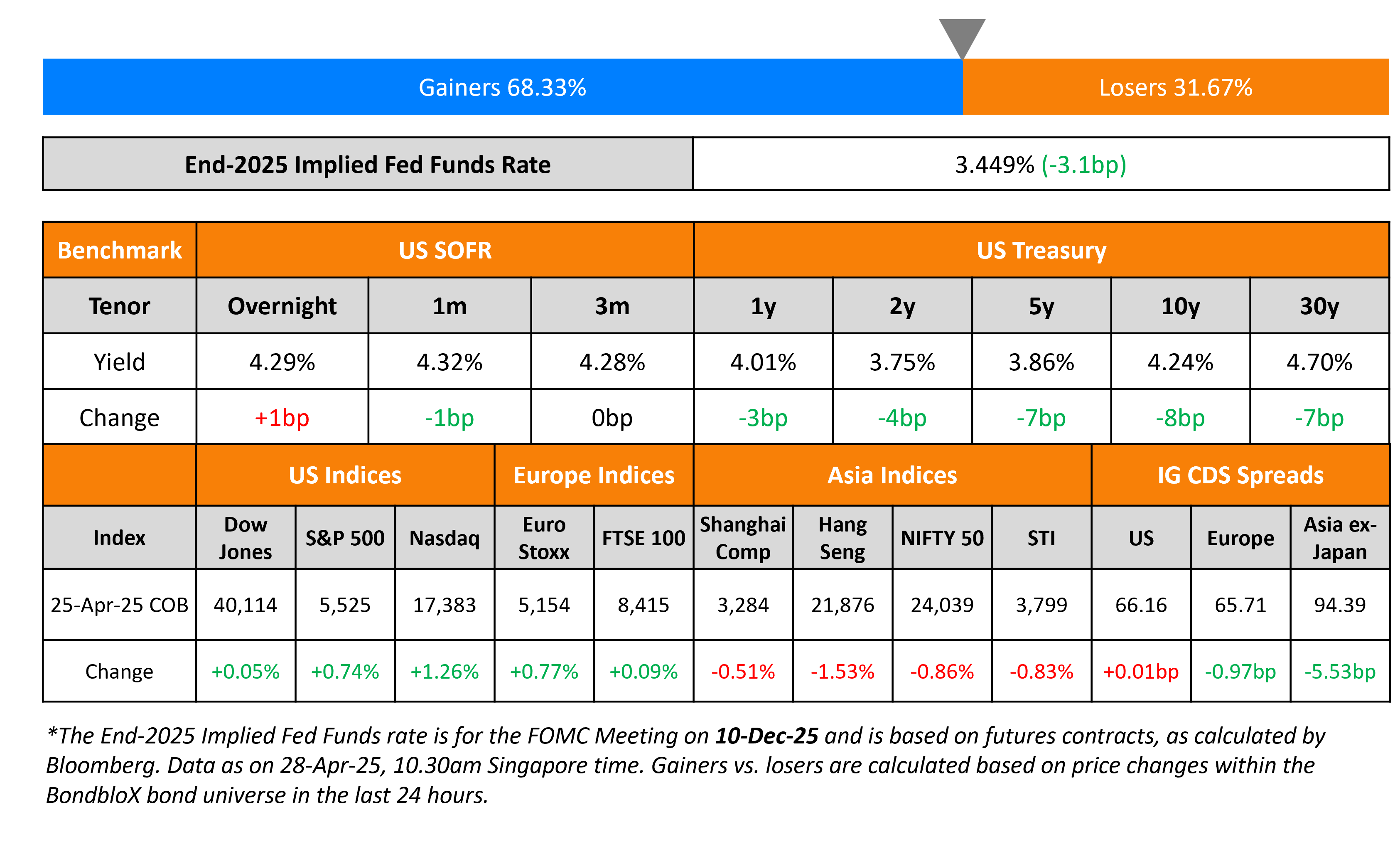

Consumer Sentiment Stays Soft; Yield Curve Flattens

April 28, 2025

US Treasury yields fell, with the yield curve flattening – the 2Y yield was down 4bp while the 10Y was down 8bp. The Michigan Consumer Sentiment Index for April came-in at 52.2, better than expectations of 50.5 and the prior 50.8 reading. As per the US government’s initial estimate, their economy is expected to grow at only 0.4% in Q1, led by its trade deficit and weakening consumer sentiment, besides the impact of the tariff announcement.

The S&P and Nasdaq extended their rally, up by 2% and 2.7% respectively. Looking at credit markets, US IG CDS spreads were flat, while HY CDS spreads widened by 0.4bp. European equity markets ended higher too. The iTraxx Main spreads were 1bp tighter while Crossover CDS spreads tightened 3.2bp. Asian equity markets have opened higher this morning. Asia ex-Japan CDS spreads were tighter by 5.5bp.

New Bond Issues

- Kookmin Bank $ 3Y / 5Y at T+120 /125bp area

- Tongyang Life insurance $ 10NC5 T2 at T+285bp area

- Posco $ 5Y / 10Y at T+180/ 200bp area

- Zhongyuan Asset Management $ 3Y at 6.2% area

Ajman Bank raised $500mn via a 5Y sukuk at a yield of 5.227%, 35bp inside initial guidance of T+165bp area. The notes are rated BBB+ (Fitch),and received orders of over $2.7bn, 5.4x issue size.

Rating Changes

-

Fitch Upgrades Pakistan Water and Power Development Authority to ‘B-‘ on Sovereign Upgrade

-

Moody’s Ratings upgrades Kirby to Baa2; outlook changed to stable

-

Fitch Upgrades Helios Towers’ IDR to ‘BB-‘; Outlook Stable

-

Fitch Downgrades Nissan Motor to ‘BB’; Outlook Negative

-

Domtar Corp. Downgraded To ‘B’ From ‘B+‘ On Increased Financial Risk; Outlook Stable

-

Fitch Downgrades Enbridge Gas Ohio’s IDR to ‘BBB+’; Outlook Stable

-

Fitch Revises Energo-Pro’s Outlook to Negative; Affirms IDR at ‘BB-‘

Term of the Day: Catastrophe Bonds

Catastrophe bonds also referred as Cat bonds are risk-linked securities that are designed in favor of the issuer as these allow the transfer of risks related to a major catastrophe or a natural disaster to the investors. These are generally high yield debt instruments that payout to issuers in case of specific triggers. These bonds essentially act as insurance policies for the issuer against natural disasters, where they pay regular coupons (premium) in exchange for protection. In the event of a natural disaster trigger, issuers will receive a payout from the proceeds of the bond and the principal repayment and interest payments are either deferred or cancelled. If a trigger event doesn’t occur, the issuer continues to pay the coupons as scheduled, similar to a regular bonds and proceeds are returned to the investors at maturity. Cat bonds are generally purchased by governments, insurance and reinsurance companies. These bonds have gained traction as the frequency of natural disasters is on the rise.

Talking Heads

On Powell, Being ‘Mr. Too Late’ Is Better Than Being Wrong

Aditya Bhave, BofA Securities

“They prefer to be late than wrong. They’re going to wait and see how things play out on both mandates”

Claudia Sahm, New Century Advisors

“You have both sides of the mandate going off track in a way where they will have to make a choice”

Lindsey Piegza, Stifel Financial

“They did not reinstate price stability. I am concerned about inflation stability with or without the tariffs. We are at risk”

On Investors Turning Focus to Global Growth After EM’s Roaring Start

“The sweet spot for EM is a US slowdown but not a recession. It’s certain that we’ll have a weaker dollar, and people are going to diversify away from dollar assets.”

Pierre-Yves Bareau, JPMorgan Asset

“Emerging markets have proved lately that they can navigate a more challenging backdrop”

Jeff Shultz, BNP Paribas

“EM has the potential to continue to outperform, and maybe that results in higher levels of flows directed”

On World’s First Catastrophe-Bond ETF Faltering in ‘Crazy’ Market

Ethan Powell, Brookmont Capital

“Some of our seed capital investors are sitting on the sidelines because the market turmoil has taken people’s eyes off new asset classes… art of me is happy we launched in the middle of all this volatility when even safe-haven assets got obliterated”

Top Gainers and Losers- 28-April-25*

Go back to Latest bond Market News

Related Posts: