This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

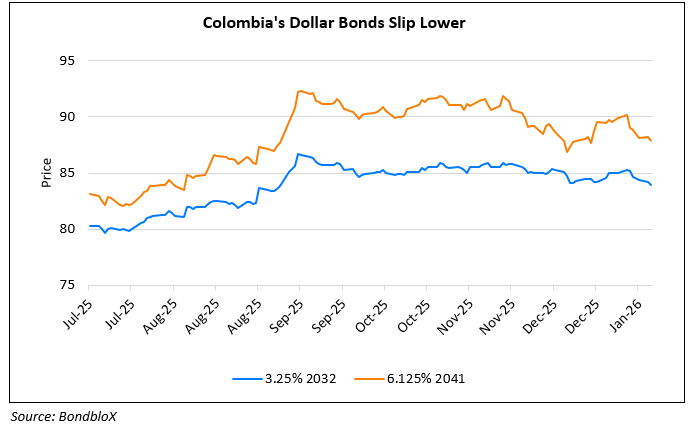

Colombia’s Dollar Bonds Slip on Political Tensions with the US

January 6, 2026

Colombia’s dollar bonds slipped lower as political tensions escalated between the US and Colombia following the ouster of Venezuela’s Nicolás Maduro. The down-move was triggered by sharp rhetoric from US President Donald Trump toward Colombian President Gustavo Petro, including personal attacks and warnings after Petro condemned the US action in Venezuela. Analysts warned that rising bilateral tensions could further pressure Colombian assets, which were already strained by domestic concerns such as a 23% minimum wage hike, fears of inflation and fiscal slippage, and uncertainty ahead of upcoming elections. Investors are increasingly wary that political risks, both external and domestic, could weigh on Colombia’s markets in the near term.

Colombia’s bonds have been trading weaker since the start of the year, dropping by 2-2.5 points across the curve.

For more details, click here

Go back to Latest bond Market News

Related Posts:

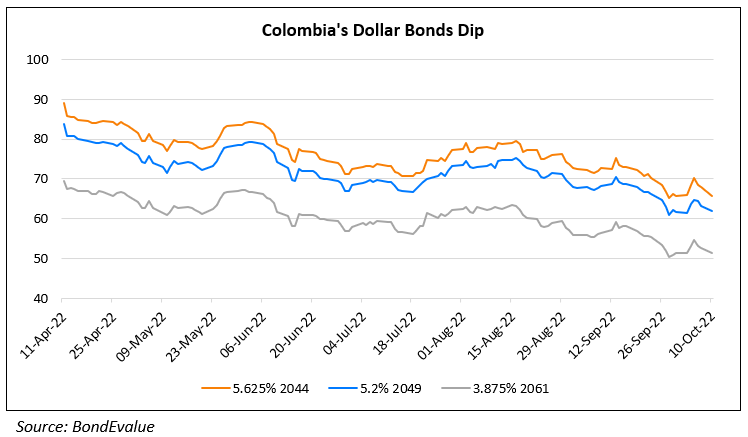

Colombia’s Dollar Bonds Near All-time Lows

October 10, 2022

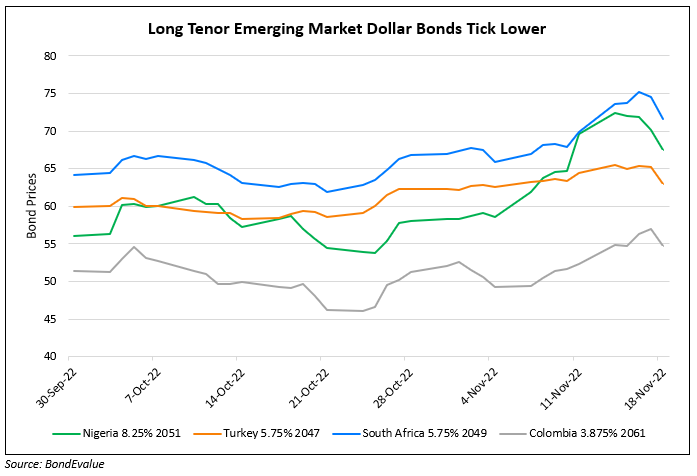

Long-Dated Bonds of EM Sovereigns Drop Over 3%

November 18, 2022