This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Colombia Downgraded to BB by Fitch

December 17, 2025

Colombia was downgraded by one notch to BB from BB+ by Fitch. The move reflects Fitch’s view that persistent large fiscal deficits and rising spending rigidities will keep Colombia’s government debt on an upward path. The agency projects a central government deficit of 6.5% of GDP in 2025 and 7.5% in 2026, with general government debt rising to about 62.8% of GDP by 2027. Although interest costs in 2025 are temporarily reduced by below-par buybacks, the interest-to-revenue ratio is projected to rise again to around 15% in 2026, increasing public finances’ exposure to slower growth, higher borrowing costs, or currency depreciation. Fitch also flags reduced predictability of fiscal policy after the government invoked the fiscal rule’s escape clause and prevailing popular sentiment against tax initiatives or spending cuts. Additionally, approaching March 2026 congressional elections will also constrain President Gustavo Petro’s reforms amid legislative setbacks, court suspensions and weak congressional traction according to Fitch.

Its bonds were trading with a negative bias, with its 8% 2033s, at 107.78 yielding 6.61%.

Go back to Latest bond Market News

Related Posts:

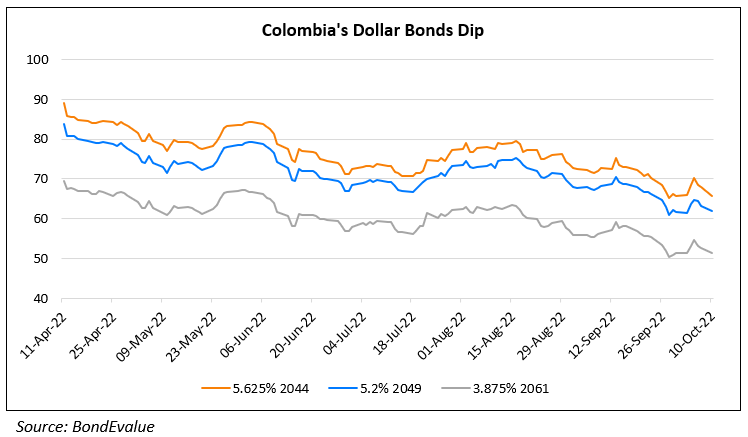

Colombia’s Dollar Bonds Near All-time Lows

October 10, 2022

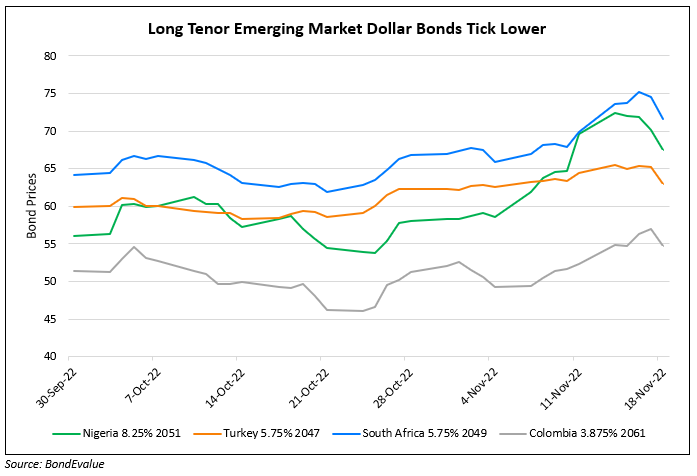

Long-Dated Bonds of EM Sovereigns Drop Over 3%

November 18, 2022