This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

CICC, Mizuho Financial Launch $ Bonds

February 5, 2026

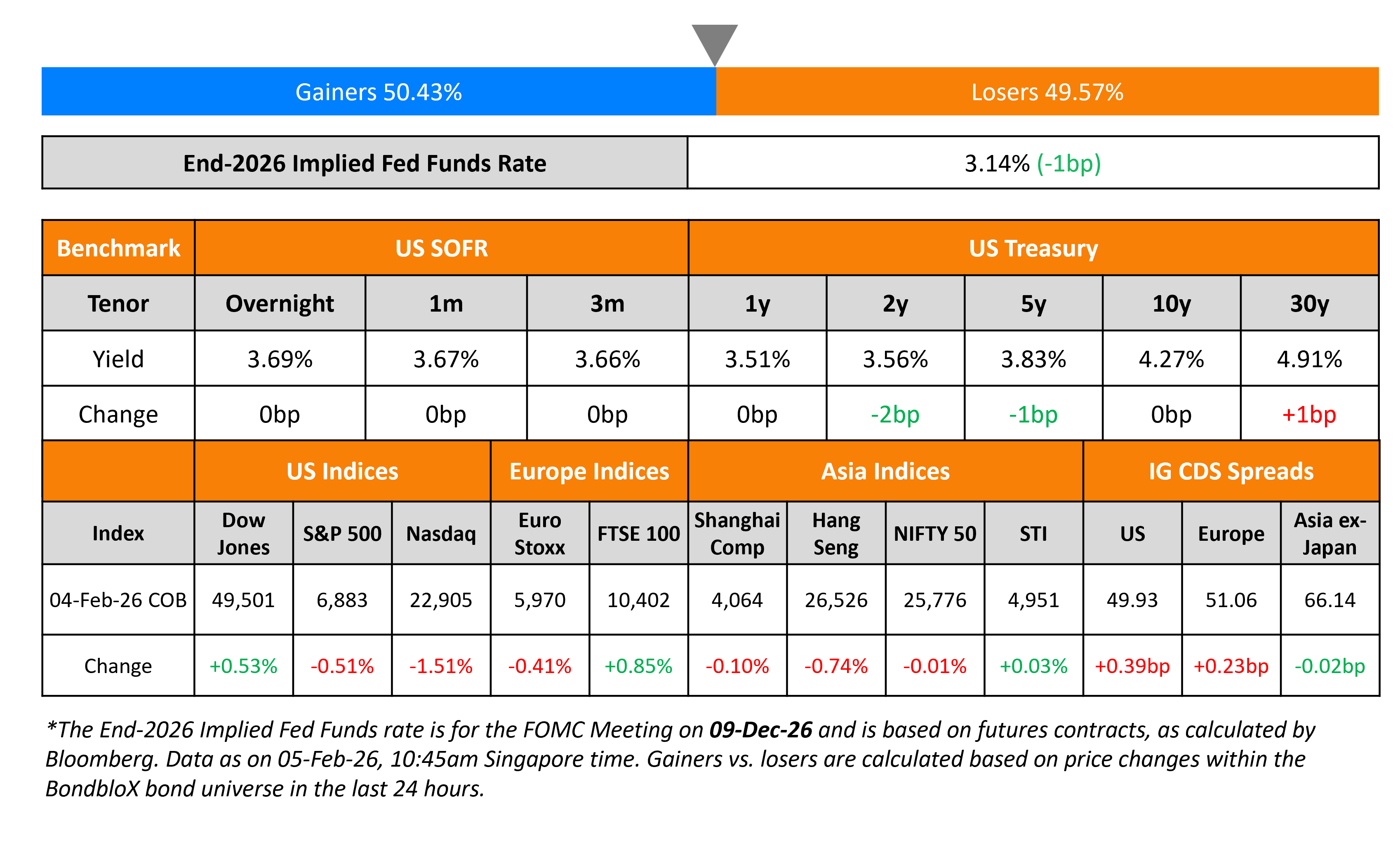

US Treasury yields were stable across the curve. The ISM Services Index reading came in at 53.8 for January, higher than the 52.8 print seen in December, whilst also beating expectations of 52.9. The US Treasury’s quarterly refunding statement noted that it anticipates keeping auction sizes unchanged for nominal notes, bonds and floating-rate notes, “for at least the next several quarters”. Separately, the US government’s partial shutdown ended yesterday after US President Trump signed a $1.2tn spending bill.

Looking at US equity markets, the S&P ended 0.5% lower and the Nasdaq closed 1.5% lower amid AI related concerns on tech businesses. US IG CDS spreads widened by 0.4bp while HY CDS spreads were 1.8bp wider. European equity indices ended mixed. The iTraxx Main CDS spreads were 0.2bp wider and the Crossover CDS spreads were 1.7bp wider. Asian equity markets have opened lower this morning. Asia ex-Japan CDS spreads were nearly unchanged.

New Bond Issues

- CICC $ 2Y/3Y at SOFR+105bp/SOFR+110bp areas

- Mizuho Financial $ 6.25NC5.25/6.25NC5.25 FRN/11.25NC10.25 at T+95-100bp/SOFR eq./T+110-115bp areas

- Korea $ 3Y/5Y at T+13/T+16bp areas

- Westpac A$ 5Y and/or 15NC10 at SQASW+75bp and/or SQASW+145bp areas

- Credit Agricole A$ 5Y and/or 15NC10 Tier-2 at SQASW+100bp and/or SQASW+190bp areas

-

Tianfeng Securities $ 2Y at 5.7% area

.png)

ING Groep raised €2.5bn via a dual-tranche deal. It raised €1.25bn via a 6NC5 bond at a yield of 3.244%, 28bp inside initial guidance of MS+100bp area. It also raised €1.25bn via an 11NC10 bond at a yield of 3.846, 28bp inside initial guidance of MS+125bp area. The senior unsecured notes are rated Baa1/A-/A+. Proceeds will be used to finance or refinance a portfolio of green loans under their green framework.

The Howard Hughes Corp raised $1bn via a two-tranche offering. It raised $500mn via a 6NC2.5 bond at a yield of 5.875%, 12.5bp inside initial guidance of 6.00% area. It also raised $500mn via an 8NC3 bond at a yield of 6.125%, 12.5bp inside initial guidance of 6.25% area. The senior unsecured notes are rated Ba3/BB-/BB. Proceeds will be used to redeem its 5.375% 2028s and for general corporate purposes.

CDB Aviation raised $500mn via a 5Y bond at a yield of 4.34%, 45bp inside initial guidance of T+95bp area. The senior unsecured notes are rated A2/A (Moody’s/Fitch). CDBL Funding 1 is the issuer and CDB Aviation Lease Finance Designated Activity Co. is the guarantor. China Development Bank Financial Leasing Co. Ltd. is the keepwell and asset purchase deed provider. Proceeds will be used for working capital and general corporate purposes.

New Bonds Pipeline

- Binghatti hires for $ long 5Y bond

Rating Changes

- Howard Hughes Holdings Inc. Upgraded To ‘B+’; Ratings Remain On CreditWatch Positive

- Moody’s Ratings downgrades Whirlpool’s CFR to Ba2; outlook remains negative

- Moody’s Ratings downgrades Kronos to B2; Outlook negative

- Fitch Revises Turk Telekom’s Outlook to Positive on Sovereign Action

- Fitch Revises Turkcell’s LTFC IDR Outlook to Positive on Sovereign Action

- Fitch Revises Turkiye Wealth Fund’s Outlook to Positive on Sovereign Rating Action

- Italian Insurer Allianz SpA Outlook Revised To Positive On Similar Sovereign Action; ‘A+’ Rating Affirmed

Term of the Day: Mid-Swaps

Mid-Swaps are essentially the mid-rate or the average of the bid-ask rates on a swap corresponding to the maturity of the bond. Whilst bonds are generally priced as a spread over Treasuries, some issuers price them over the Mid-Swaps rate. Many euro denominated bonds are priced as a spread over the Mid-Swaps rate. The ‘swap rate’ is essentially the fixed-rate that the receiver gets in exchange for paying the floating rate in a Swap contract with the Mid-Swaps being the average of the bid-ask swap rates.

Talking Heads

On time to ‘wait and see’ on rates – Lisa Cook, Fed Govenor

“At this time, I see risks as tilted toward higher inflation… We put a lot of easing into the pipeline at the end of last year and I think that given where the labor market is, where inflation is, this is the right time to sit back and wait to see what happens”… Monetary policy is currently “ever so mildly restrictive”

On Seeing End to Japanese Debt Buyer Strike – Mizuho Strategists

“The buying strike we’ve seen in the ultra-long end may soon be over after the election uncertainty is out of the way”… A rise in the 10-year JGB yield toward 2.5% “was viewed as a good buying opportunity”.

On South Korean Debt Most Exposed in Asia to Steeper Treasury Curve

Stephen Chiu, Bloomberg Intelligence

“Korean Treasury bond curve is the most vulnerable in emerging Asia to a US Treasury curve steepening”

Yea Ha Ahn, a fixed-income analyst at Kiwoom Securities

“Expect a further steepening in the Korea government bond curve from catalysts including a potential supplementary budget within the year and rising inflationary expectations”

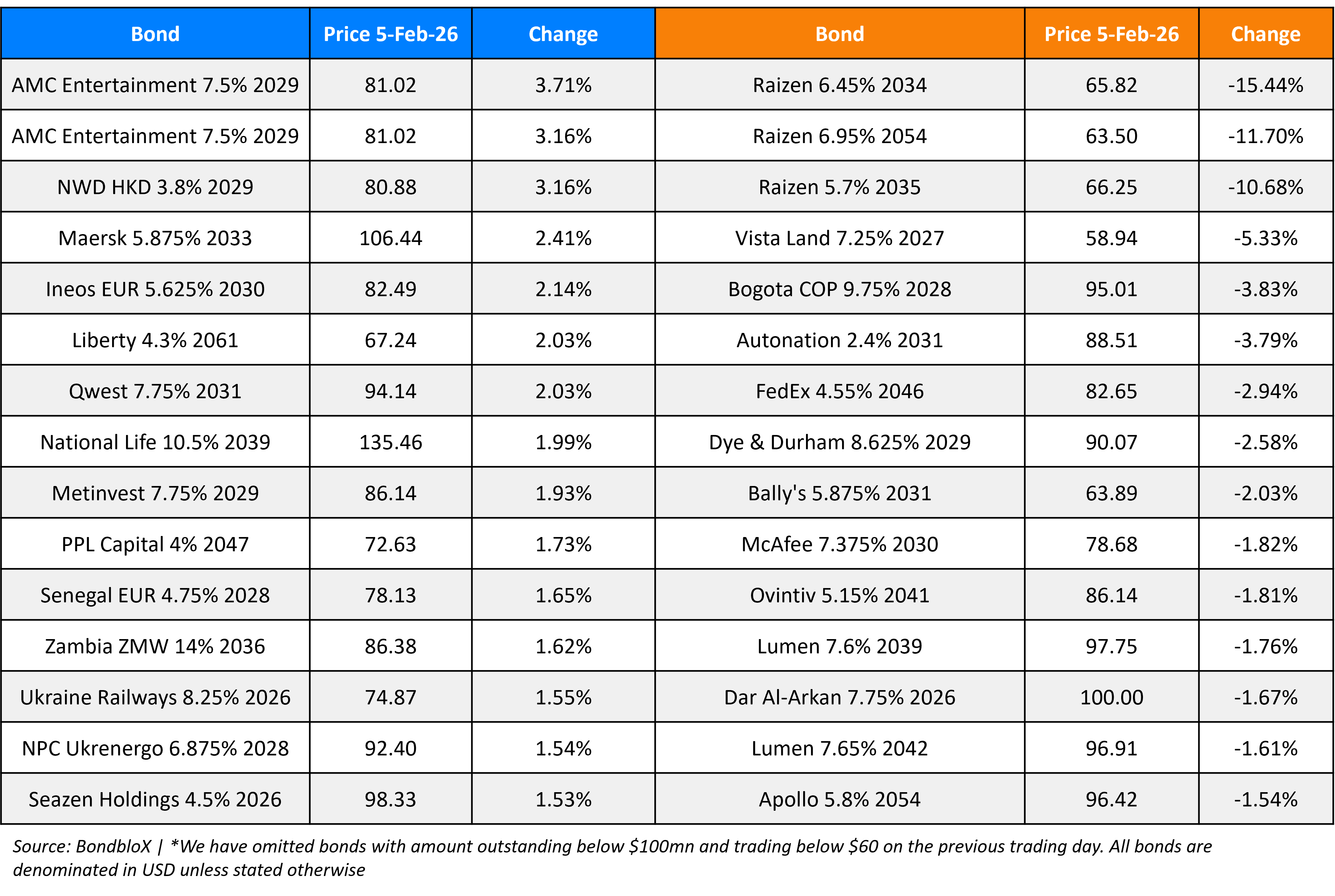

Top Gainers and Losers- 05-Feb-26*

Go back to Latest bond Market News

Related Posts: