This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Chinese SOEs’ Bonds Drop With Doubts on Government Support; Middle East Looks at More Sukuks; Emirates Suffers First Loss in 30 Years; Revlon Staves Off Bankruptcy

November 13, 2020

S&P and Nasdaq posted losses of 1% and 0.65% yesterday. Sectors that dragged the broad market included energy down 3.3% while utilities and financials were down 1.7% each. Both headline and core CPI came in softer than expected while jobless claims numbers printed 709k for the week ending Saturday, falling by 48,000 to a seven-month low. US 10Y and 30Y yields fell 7bp and 8bp from Tuesday’s close with the soft inflation data, increased Covid cases and fading vaccine sentiment. US IG and HY CDS spreads rose 2bp and 19bp whereas Europe’s main and crossover CDS spreads widened 2bp and 6.6bp. Asia ex-Japan CDS spreads are 0.70bp wider and Asian equities have moved lower ~0.3%.

Bond Traders’ Masterclass : Last Day to Avail the Additional 10% Discount

Avail an additional discount before it ends today. End the year by knowing the Theory and the Practical aspects of the Bond Market. BondEvalue is conducting a special Bond Traders’ Masterclass across five sessions specially curated for private bond investors and wealth managers to develop a strong fundamental understanding of bonds. The sessions will be conducted by debt capital market bankers with over 40 years of collective experience at premier global banks. Click on the image below to register.

Avail an additional 10% discount on the Masterclass package by registering before 13 Nov 2020

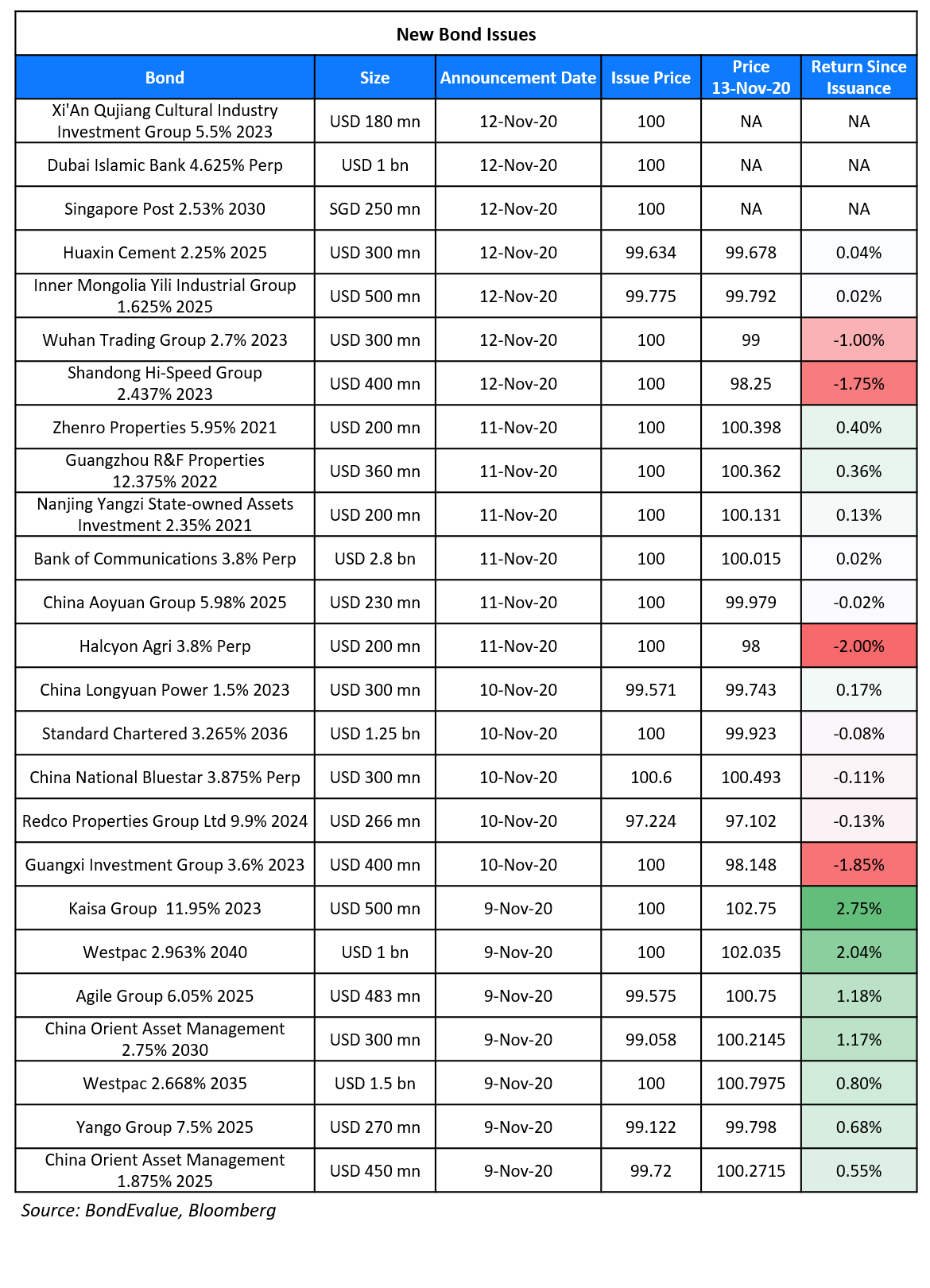

New Bond Issues

Russia raised €750mn ($885mn) via a 7Y at a yield of 1.125%, 12.5bp inside initial guidance of 1.25%. The bond was issued alongside a 12Y Rouble denominated Eurobond. The combined orders for both bonds were over €2.7bn ($3.2bn) according to sources, with most interest coming from domestic investors. Moscow has been seeking additional sources of funding to make up for a budget shortfall caused by lower oil prices and the pandemic, and has plans to increase its public debt to ~19% of GDP this year.

Inner Mongolia Yili Industrial Group, the Chinese dairy giant raised $500mn via a 3Y bond at a yield of 1.672%, 35bp inside initial guidance of T+160bp area. The bonds have expected ratings of A3/A-, and received orders over $1.4bn, x issue size. Asia took 81% of the bonds, EMEA 18% and offshore US 1%. Asset managers and fund managers were allocated 66%, banks 33%, and private banks and others 1%. The bonds will be issued by wholly owned subsidiary Yili Holding Investment and guaranteed by the Shanghai-listed parent company. Proceeds will be used for refinancing purposes.

Shandong Hi-Speed raised $400mn via a 3Y bond at a yield of 2.437%, 20bp inside initial guidance of T+240bp area. The bonds have expected ratings of Baa1/A, and received orders over $1.4bn, 3.5x issue size. The proceeds will be used for debt repayment and general corporate purposes. The bonds will be issued by Shandong Hi-Speed Group (Hong Kong) and have a keepwell and liquidity support deed, and a deed of equity interest purchase undertaking (EIPU) provided by Shandong Hi-Speed Group.

Wuhan Trading Group raised $300mn via a 3Y bond at a yield of 2.7%, 35bp inside initial guidance of 3.05% area. The bonds are rated BBB+ by Fitch and received orders over $1.1bn, ~3.6x issue size. Proceeds will be used for refinancing debt, working capital and general corporate purposes.

XiAn Quijiang Cultural Industry Investment Group raised $180mn via a 3Y bond at a yield of 5.5%, 20bp inside initial guidance of 5.7% area. The bonds are unrated. Proceeds will be used for the construction of projects in China, refinancing onshore debt and general working capital.

SingPost raised S$250mn ($185.2 mn) via a 10Y at a yield of 2.53%, 27bp inside initial guidance of 2.8% area. Fund Managers, insurance companies and agencies took 54%, private banks and Banks took 24% and 22% respectively with Singapore accounting for 93% of the orders. The issuer is Singpost Group Treasury Pte Ltd and Singapore Post is guarantor. Singapore Post is rated BBB+ by S&P, but the benchmark notes are unrated. Proceeds will be used for general corporate needs including debt refinancing.

Huaxin Cement raised $300mn via a 5Y at a yield of 2.328%, 30bp inside initial guidance of T+220bp area. Orders received were over $900mn, 3x issue size for the bonds with expected Baa1 ratings. Asia took 70% of the bonds and EMEA 30%. Fund managers bought 61%, banks and insurance 24%, sovereign wealth funds 14%, and private banks and others 1%. The proceeds will be used for capital expenditure and other general corporate purposes.

New Bonds Pipeline

- CALG $70mn 5.9% 5Y privately placed bonds

- IIX 4Y Women’s Livelihood Bond

- Aviva Singlife $/S$ Tier 2

Rating Changes

Washington Prime Group Inc. Downgraded To ‘CC’ By S&P On Active Debt Negotiations, Outlook Negative

Moody’s places Unibail Rodamco Westfield ratings on review for downgrade

Fitch Removes Red de Carreteras de Occidente from Negative Watch; Assigns Negative Outlook

Ratings On Previous PizzaExpress Structure Withdrawn By S&P Following Completion Of Restructuring

Chinese SOEs’ Bonds Drop With Doubts on Government Support

Recent stresses on state owned enterprises (SOEs) saw a huge movement in the bonds due to concerns over the state support to these enterprises. Some of the affected SOEs are as follows.

Yunnan Metropolitan Construction Investment Group Co.’s 5.5% 2022s dropped ~70% by 25 points to 52.25. This massive drop comes on the back of recent falls in other SOEs’ bonds with Yongcheng Coal & Electricity Holding Group Co Ltd, that defaulted less than a month after issuing a new bond and Tsinghua Unigroup’s dollar bonds seeing a sharp fall over the last few weeks.

Yongcheng Coal, rated AAA by a domestic rating firm, said on November 10 that it was unable to make principal and interest payments on CNY 1bn ($151mn) of short-term CPs maturing that day due to tight liquidity, constituting a default. Only a few weeks earlier on October 20, the company issued a CNY 1bn ($151mn) 3Y note. Post the default the rating was cut directly to BB. National Association of Financial Market Institutional Investors (NAFMII) said it would launch an investigatory action into Yongcheng regarding risk disclosures.

Tsinghua Unigroup has also made headlines for requiring extension of a trust loan. A missed payment could lead to a first default of their trust loan and might spill over even to its dollar bonds. As per REDD, Tsinghua is seeking bank loans to refinance their 5.6% CNY 1.3bn ($200mn) bond due in two days but banks are still having internal discussions on whether to approve the credit line. They were also put on a downgrade watchlist by a local credit rating agency with analysts waiting to see if they get government support. Unigroup’s 6% 2020s have fallen ~65% since the beginning of November to 27 cents on the dollar.

“Yunnan Metropolitan bears some resemblance to Unigroup in that it is also an unrated SOE issuer who counts on government support to pay down debt… Yongcheng Coal’s default serves as the latest

example of the government letting debt-laden SOE firms fail… All that has impacted the overall sentiment in the offshore market toward weaker SOEs’ dollar bonds” said the ED of BOC International Holdings Ltd.

Banxico Surprises With Rates on Hold; Argentina Central Bank Hikes; Egypt Cuts Rates

Banxico, Mexico’s Central Bank kept its benchmark interest rate at 4.25%, in a 4-1 vote after inflation held above the bank’s ceiling for three consecutive months. 16 of 22 economists surveyed by Bloomberg expected a 25bp cut and hence the decision was a surprise. “The door for rate cuts is closed, at least for now as Banxico says this is a pause to give inflation space to confirm its trend toward the target… we continue to believe that inflation will remain relatively high next year and will limit Banxico’s room to cut”, said an economist at BofA. In addition, the central bank announced a switch auction (Term of the day, explained below). Mexico’s dollar bonds moved slightly lower – 4.75% 2044s were down 0.24 to 117.48.

For the full story click here

In another LATAM central bank news, Argentina’s Central Bank, BCRA, raised its benchmark Leliq rate by 2% to 38% alongside its repo and retail CD rates according to a spokesman. The move came immediately after October’s inflation printed at 3.8%, the highest this year and higher than expectations for 3.1%. Thursday’s policy decision is the fifth increase for the repo rate since October 1 as the BCRA has sought to encourage Argentines to save and invest in pesos. The action comes after the sovereign has taken several policy decisions to to stem inflation and a weakening Peso, which included currency controls. Argentina’s dollar bonds jumped higher – 0.125% 2030s up 5% or 2 points to 40.125% and 0.125% 2035s up 7% or 2.5 points to 36.93.

For the full story click here

In related monetary policy news, the Central Bank of Egypt cut its benchmark deposit rate for the second consecutive time to 8.25% by 50bp. Despite consumption rising, it was not enough to offset the combined reduction in investments and net exports, they noted. “The outlook for inflation in 2020 Q4 is estimated to be in the low single digits range, with increasing likelihood of coming under the inflation target floor of 6%” the central bank stated. Egypt’s dollar bonds moved slightly higher – 6.875% 2040s up 0.33 to 98.94.

For the full story, click here

China Hongqiao Bonds Drop Post Debt Downgrade

China Hongqiao saw its unit’s local debt (to which it is a guarantor) downgraded by a local credit rating agency. China Lianhe Credit Rating Co cited the parent’s weakened repayment ability and the financial health of the parent as guarantor. The rating agency downgraded two local bonds of China Hongqiao’s key unit Shandong Weiqiao Aluminum and Power Co. to AA+ from AAA, citing weaker financial health of the parent as guarantor. “The effectiveness of China Hongqiao’s guarantee to the two bonds has been weakened as there is uncertainty in raising funds to repay the debt” the ratings company said. China Hongqiao is among the biggest private aluminium smelter companies which saw revenues get hit amid the pandemic. The company has CNY21bn ($3.2bn) in outstanding bonds payable in one year. China Hongqiao is rated B1/B+/BB- by the three major rating agencies and its dollar bonds dropped on the back of the local rating agency’s report – its 7.375% 2023s fell 3.5 points to 89.52 on the news, yielding 12.45% on secondary markets.

Middle East Looks at More Sukuk Issuances to Tap the Debt Market

Middle east continues to rely on Sukuk issuances to tap the debt market. The total debt issuance from the Gulf has topped $100bn, surpassing the issuances of last year. The issuances are targeting both on-shore as well as off-shore debt markets. Dubai Islamic Bank and Oman were the latest to join the bandwagon of Sukuk issuances.

Dubai Islamic Bank, UAEs largest lender, raised $1bn via a Perp non-call 6Y (PerpNC6) AT1 Sukuk at a yield of 4.625%, 62.5bp inside initial guidance of 5.25% area. The bonds received over $5.5 bn in orders, 5.5x issue size. The sukuk’s first call date is in May 2026 and coupon will reset in November 2026 at US 6Y + 407.7bp. The bond has a dividend stopper too.

AT1’s are inherently considered risky instruments as they are perpetual in nature. First Abu Dhabi Bank, Emirates NBD and Commercial Bank of Dubai of UAE have already sold AT1 bonds this year to provision the loan loss provisions amid the coronavirus crisis.

“Very tight pricing, coupled with a 5-1/2-times oversubscription (5.5x) , indicates high interest from investors as they lack alternative shariah-compliant instruments, in which there has been a long mismatch between supply and demand,” a fixed income strategist said.

The table below shows the Sukuk issuances for UAE in 2020.

For the full story, click here

In a related news Oman issued its first sukuk for retail investors under its Omani RialSukuk Issuance Program. This Series 4 issuance was for an amount of ~RO 220mn ($519.5mn) at 4.5% pa paid semi annually with a maturity on November 24, 2022. The government plans to follow this up with a Public Offer – Series 5 Sukuk Certificates due in 2022.

Emirates Group Announces Half-Year Performance; Suffers First Loss in 30 Years

On Nov 12, The Emirates Group announced its half-year results for 2020-21 where it revealed that it had suffered the first loss in more than 30 years when it experienced a net loss of AED 14.1 bn ($3.8bn). It revealed that it was quick to adapt to the lockdown as a result of the lockdown and prioritized cargo operations and other areas of opportunity which allowed it to recover revenues from zero to 26% thus “demonstrating agility and resilience in the face of current headwinds.” The airlines also said that it was difficult to forecast the future but was hopeful of a steep recovery. The highlights of the results are as follows.

- The revenue of The Emirates Group were down 74% to AED13.7bn ($ 3.7 bn). It suffered a loss of AED14.1bn ($3.8bn) against a profit of AED1.2bn ($320mn) last year.

- The revenue of Emirates airlines were down 75% to AED 11.7 bn ($ 3.2 bn) and the losses were up to AED 12.6bn ($3.2bn) against profit of 862mn last year. Most of the revenue came from its cargo business.

- The revenue of its airport service were down 67% to AED 2.4 bn ($ 644 mn) and the losses were up to AED 1.5 bn ($ 396 mn)

- The Group’s cash position on 30 September 2020 stood at AE20.7bn ($5.6bn), compared to AED25.6bn ($7.0bn) as at 31 March 2020.

Sheikh Ahmed bin Saeed Al Maktoum, Chairman and Chief Executive, Emirates Airline and Group said “We began our current financial year amid a global lockdown when air passenger traffic was at a literal standstill. In this unprecedented situation for the aviation and travel industry, the Emirates Group recorded a half-year loss for the first time in over 30 years.” and added “The Emirates Group’s resilience in the face of current headwinds is testimony to the strength of our business model, and our years of continued investment in skills, technology and infrastructure which are now paying off in terms of cost and operational efficiency.”

Emirates Airlines 4.5% bonds maturing in 2025 were up 0.09 and traded at ~100.6 points

For the full story, click here

In a related news Singapore Airlines revealed through an exchange filing that it plans to raise ~S$850mn ($630mn) via sale of convertible bonds due on 3 December 2025. The bonds will bear interest at the rate of 1.625% per annum, payable semi-annually. The funds from the bond issuance are required due to the disruptions in the air travel on account of the pandemic and would cater to operating cash flow, debt servicing and capital expenditure. SIA’s 3.13% bonds maturing in 2026 and 2027 were up 0.03 and 0.11 and were trading at 98.5 and 98.3 cents on the dollar respectively.

For the full story, click here

In more news on the aviation sector, Colombia´s biggest airline Avianca decided against accepting a $370 mn government aid as it deemed adequate the support of institutional investors and existing lenders. This move is significant since the D rated company is in the process of a $2bn restructuring plan. Avianca’s 9% 2023’s were trading at 15 cents on the dollar.

For the full story, click here

Revlon Narrowly Staves Off Bankruptcy

Revlon in a latest update got the required amount of bondholders for their exchange offer as part of its debt restructuring program to avoid bankruptcy. “The company does not expect that any bankruptcy or insolvency proceeding will be necessary”, it said in a statement. We noted yesterday that investors were bracing for an eleventh hour rescue for the company. Revlon’s 5.75% bonds due 2021 rallied 38.6 points to 96, almost 70% higher.

For the full story, click here

Term of the Day

Switch Auction

A switch auction is an auction in which existing bondholders have an opportunity to move their bonds’ maturity out to a number of designated bonds with longer maturities. The rates on these bonds are determined by investors through an open auction mechanism. The objective is to enable the government to consistently issue new bonds in all market conditions, including periods of fiscal balances or surpluses.

Talking Heads

“If we don’t do another COVID bill, we’re headed back to the old, unsustainable deficit path we were on,” Goldwein said.

On Trump’s ban on US investments in firms linked to Chinese military

Peter Navarro, White House trade adviser

“This is a sweeping order designed to choke off American capital to China’s militarization,” he said.

Marco Rubio, Republican senator

“Today’s action by the Trump administration is a welcome start to protecting our markets and investors,” said Rubio. “We can never put the interests of the Chinese Communist Party and Wall Street above American workers and mom and pop investors.”

“We were able to stabilise the exchange rate, which was steadily depreciating then at around the ₹ 185 (to the US dollar) and to service the foreign debt of 4,200 million dollars, averting the country being classified into a debt default status,” he said.

On Mexico keeping borrowing rates constant in surprise halt to monetary easing cycle

Mexico’s central bank surprised markets by halting a record monetary easing cycle that has lent one of the few supports to an economy expected to contract nearly 10% this year.

In a statement by Banco de Mexico board members

“This pause provides necessary space to confirm a path for inflation to converge to its goal,” bank board members wrote. “Going forward, monetary policy will depend on the evolution of factors that affect headline and core inflation.”

Carlos Capistran, economist with Bank of America Corp

“The door for rate cuts is closed, at least for now as Banxico says this is a pause to give inflation space to confirm its trend toward the target,” said Capistran. “We continue to believe that inflation will remain relatively high next year and will limit Banxico’s room to cut.”

Gabriel Casillas, chief economist at Mexico’s second-biggest lender, Banorte

“It seems that we are not understanding well the central bank communication. We will have to read today’s meeting minutes even more carefully,“ said Casillas. “All the stars were aligned for a rate cut” and so “with an extremely limited fiscal support to tackle the pandemic, it seemed like a must do.”

“The cut confirms the central bank is focusing on private investment, reviving consumption and alleviating pressure on the fiscal budget,” said El-Swaify. “The magnitude and pace of monetary easing have been very gradual to preserve foreign interest in local debt instruments in light of volatile global growth dynamics,” El-Swaify said.

Top Gainers & Losers – 13-Nov-20*

Other Stories

- Sri Lanka repaid USD 4.2 billion, avoided debt default: PM Rajapaksa

- SEBI may rebuff Amazon on Future-Reliance deal

- Australia’s Telstra to split into three, seeks buyer for mobile towers

- European Union Planning Return to Capital Markets next Week with new 15 Year SURE bond

Go back to Latest bond Market News

Related Posts: