This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Brazilian Airlines Gol and Azul Report Large Losses Amid Increasing Debt Load

August 19, 2024

Brazilian air carrier Gol reported net losses of $713mn in the previous quarter, reversing profits seen during the same period last year. The airline said that exchange rate variation made its gross debt jump by $494mn, and highlighted the impact of a decline in passenger demand and capacity. This was on the back of the closure of Porto Alegre’s Salgado Filho airport. Similarly, its peer Azul reported a net loss of $706mn in the previous quarter whilst also raising its net debt forecast. The real’s weakness and rising fuel prices were again cited as major factors for the results. As per Bloomberg, Azul’s bonds are the worst performing among EM corporates this quarter.

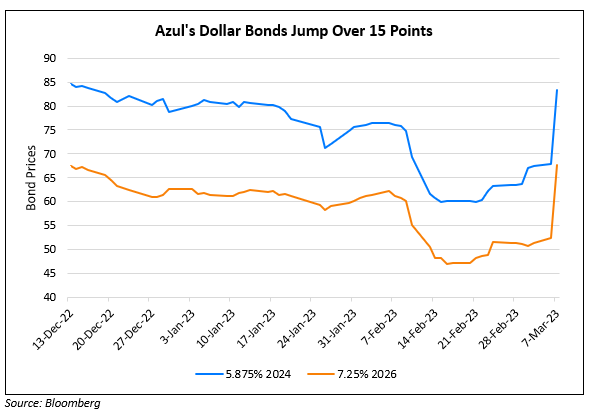

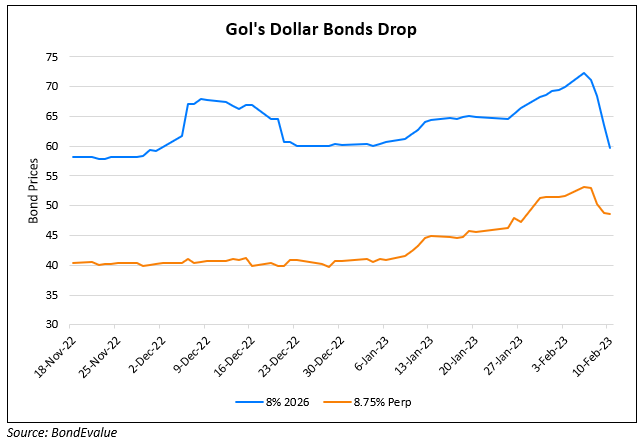

Gol’s dollar bonds were trading steady with its 8% 2026s at 71.5. Azul’s dollar bonds were also trading stable with its 7.25% 2026s at 81.1.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Gol-Azul Announce Codeshare Agreement

May 27, 2024

Gol’s Dollar Bonds Drop on Downgrade to CC by S&P

February 10, 2023