This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Brazil, BNP, Alphabet and others Price Bonds

February 10, 2026

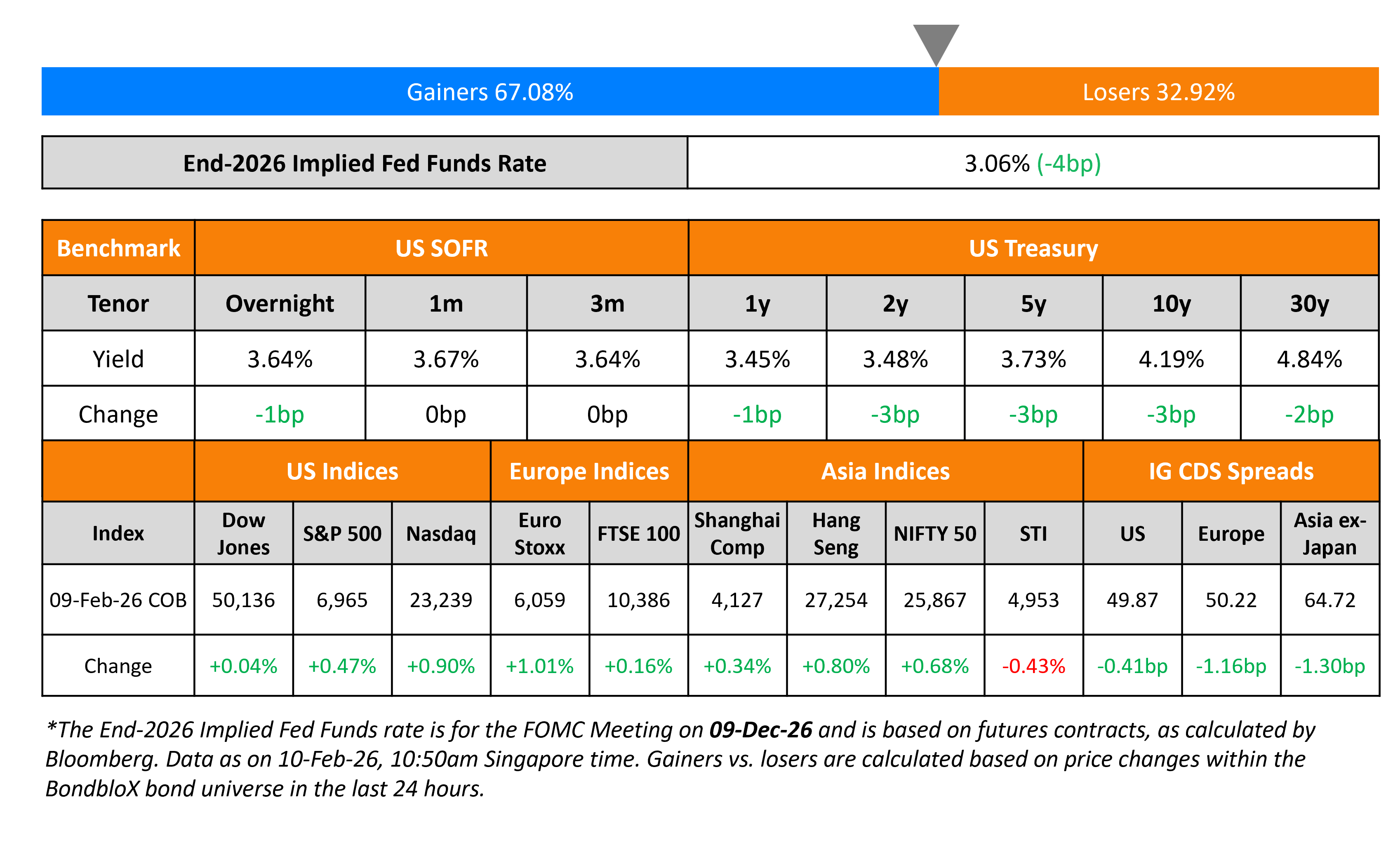

US Treasury yields moved lower by 2-3bp on Monday. There were no major data points or catalysts yesterday. Federal Reserve Governor Stephen Miran said that the Fed’s balance sheet needs to be smaller but that should not prevent them from opting for large-scale asset purchases during an economic crisis.

Looking at US equity markets, the S&P and Nasdaq closed 0.5% and 0.9% higher respectively. US IG CDS spreads tightened by 0.4bp and HY CDS spreads were 2.5bp tighter. European equity indices ended higher too. The iTraxx Main CDS spreads were 1.2bp tighter and the Crossover CDS spreads were 3.4bp tighter. Asian equity markets have opened higher this morning. Asia ex-Japan CDS spreads were tighter by 1.3bp.

New Bond Issues

- CDL Hospitality REIT S$ PerpNC5.5 at 4.25% area

- Central Nippon Expressway $ 5Y at MS+64bp area

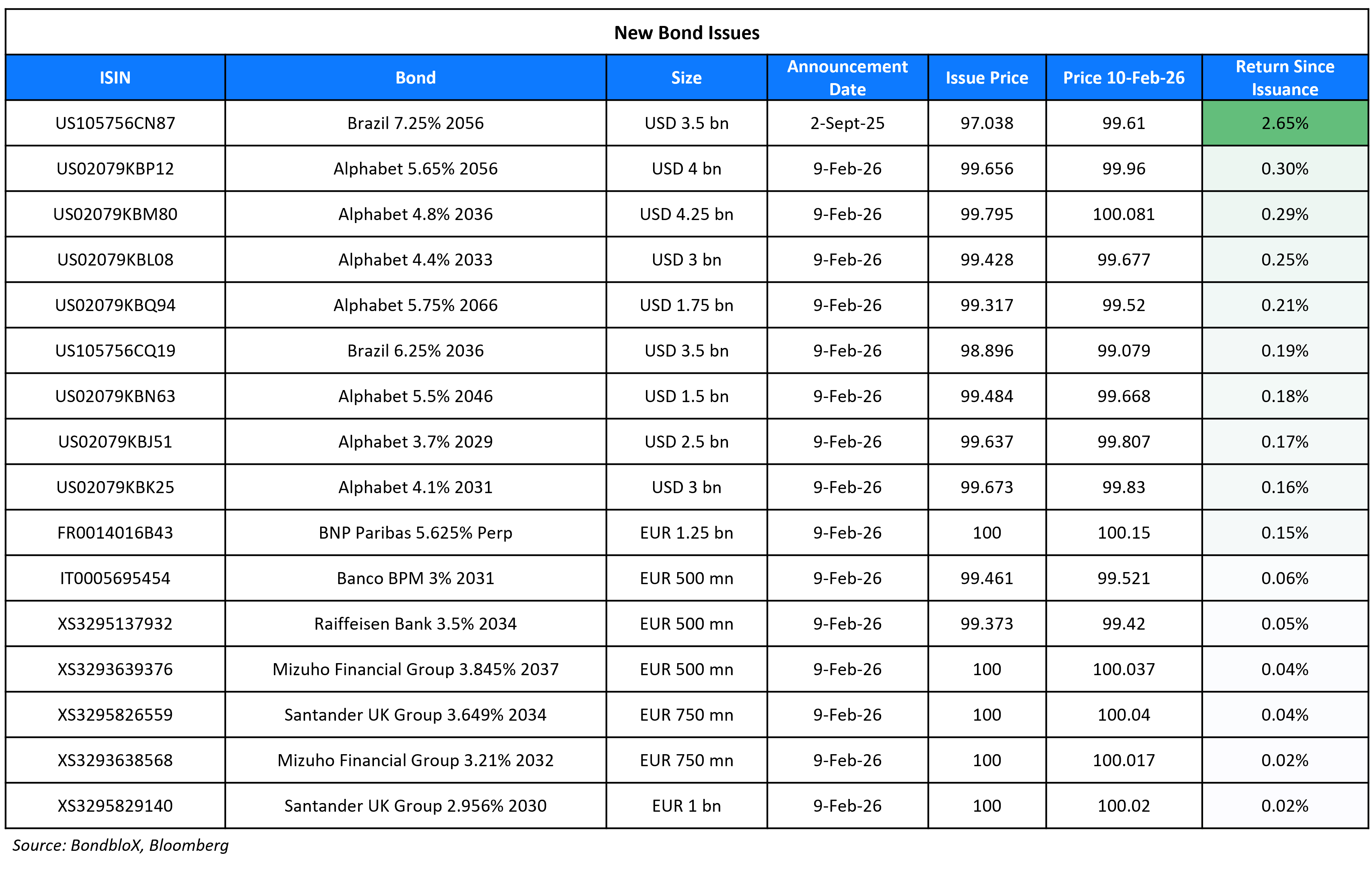

Brazil raised $4.5bn via a two-tranche deal. It raised $3.5bn via a 10Y bond at a yield of 6.4%, 30bp inside initial guidance of 6.7% area. It also raised $1bn via a tap of its 7.25% 2056s at a yield of 7.3%, 30bp inside initial guidance of 7.6% area. The senior unsecured notes are rated Ba1/BB/BB. Proceeds will be used to repay outstanding federal public debt.

BNP Paribas raised €1.25bn via a PerpNC7 AT1 bond at a yield of 5.625%, 50bp inside initial guidance of 6.125% area. The junior subordinated note is rated Ba1/BBB-/BBB, and received orders of over €3.75bn, 3x issue size. If not called by 16 February 2033, the coupon will reset to the 5Y Mid-Swap plus 305.2bp. A trigger event will occur if at any time, the group CET1 ratio is less than 5.125%.

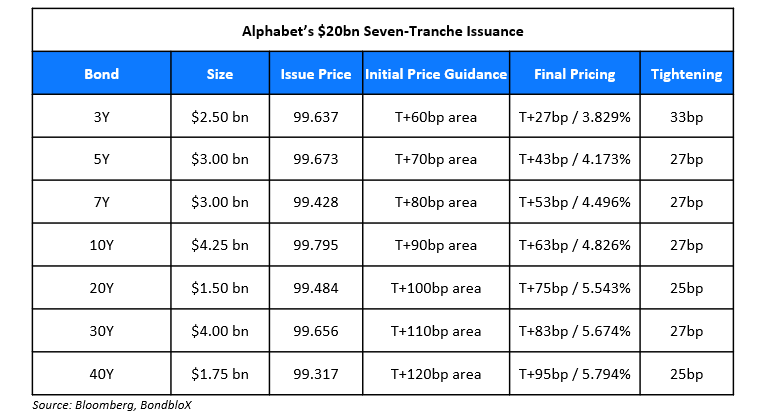

Alphabet raised $20bn via a seven-trancher.

The senior unsecured notes are rated Aa2/AA+, and received peak orders of over $100bn, 5x issue size. Proceeds will be used for general corporate purposes, which may include repaying outstanding debt.

Mizuho Financial Group raised €1.25bn via a two-trancher. It raised €750mn via a 6.25NC5.25 green bond at a yield of 3.212%, 30bp inside initial guidance of MS+100bp area. It also raised €500mn via a 11.25NC10.25 bond at a yield of 3.847%, 27bp inside initial guidance of MS+125bp area. The senior unsecured notes are rated A1/A- (Moody’s/Fitch). Net proceeds will be used to make a loan that is intended to qualify as Internal TLAC. Proceeds from the green note will be used to finance and/or refinance existing and/or new eligible green projects.

Santander UK raised €1.75bn via a two-trancher. It raised €1bn via a 4NC3 bond at a yield of 2.956%, 25bp inside initial guidance of MS+90bp area. It also raised €750mn via a 8NC7 bond at a yield of 3.649%, ~27.5bp inside initial guidance of MS+125/130bp area. The senior unsecured notes are rated Baa1/BBB/A.

Banco BPM raised €500mn via a 5Y social bond at a yield of 3.118%, 30bp inside initial guidance of MS+95bp area. The senior preferred note is rated Baa1/BBB/BBB+. Net proceeds will be used to finance or refinance eligible social loans.

New Bonds Pipeline

- Congo $ 7Y bond

- Emirates NBD € 5Y bond

- Tyson Foods investor calls

- IMB Bank A$ 10NC5 Tier-2 bond

Rating Changes

- Fitch Upgrades Lumen, Level 3 and Qwest IDRs to ‘B’

- Fitch Upgrades China Vanke to ‘CC’; Affirms Vanke HK at ‘CC’

- Fitch Downgrades Raizen’s IDR to ‘CCC’

- Raizen S.A. Downgraded To ‘CCC+’ And Placed On CreditWatch Negative On Heightened Risks Of Debt Restructuring

- Moody’s Ratings Downgrades Raizen to Caa1, negative outlook

- Transocean Ltd. Ratings Placed On CreditWatch Positive On Announced Valaris Acquisition

- Fitch Revises GeoPark’s Outlook to Positive; Affirms IDRs at ‘B+’

- Fitch Places Frontera’s Senior Notes on Rating Watch Positive; Affirms IDRs at ‘B’; Outlook Stable

Term of the Day: Convertible Bonds

As the name suggests, convertible bonds are debt instruments issued by a company where the bonds can be converted into equity shares of the company by the bondholders at a particular ratio and at particular points in time. Thus, it is a hybrid security as it has characteristics of both debt and equity. Convertibles generally carry a lower coupons and sometimes tax advantages for the issuer.

Talking Heads

On Japan Bond Blowout Funneling Corporate Borrowers to Convertibles

Takamasa Ochi, Morgan Stanley MUFG Securities

“In our discussions with corporates, rising share prices and higher interest rates have led to more conversations around convertible bonds”

Shu Nagata, BofA Securities

“There is now a broader recognition that interest rates are on an upward path. With funding costs rising as interest rates increase, companies may consider equity-like financing options such as CBs, including hybrid instruments.”

On Trump-Induced Crypto Euphoria May Be Fading – Christopher Waller, Fed Governor

“Some of the euphoria that came into the crypto world with the current administration, some of that’s kind of fading… I think there was a lot of selloff just because firms that got into it from the mainstream finance had to adjust their risk positions”

On Warning AI Debt Wave Needs $300bn in New Capital – RBC BlueBay

“The size of your new issue books don’t matter one bit because all that demand can evaporate in a second… focus on how the market is responding to the broader narrative… We’ve been so used as a market to getting bailed out by policymakers”

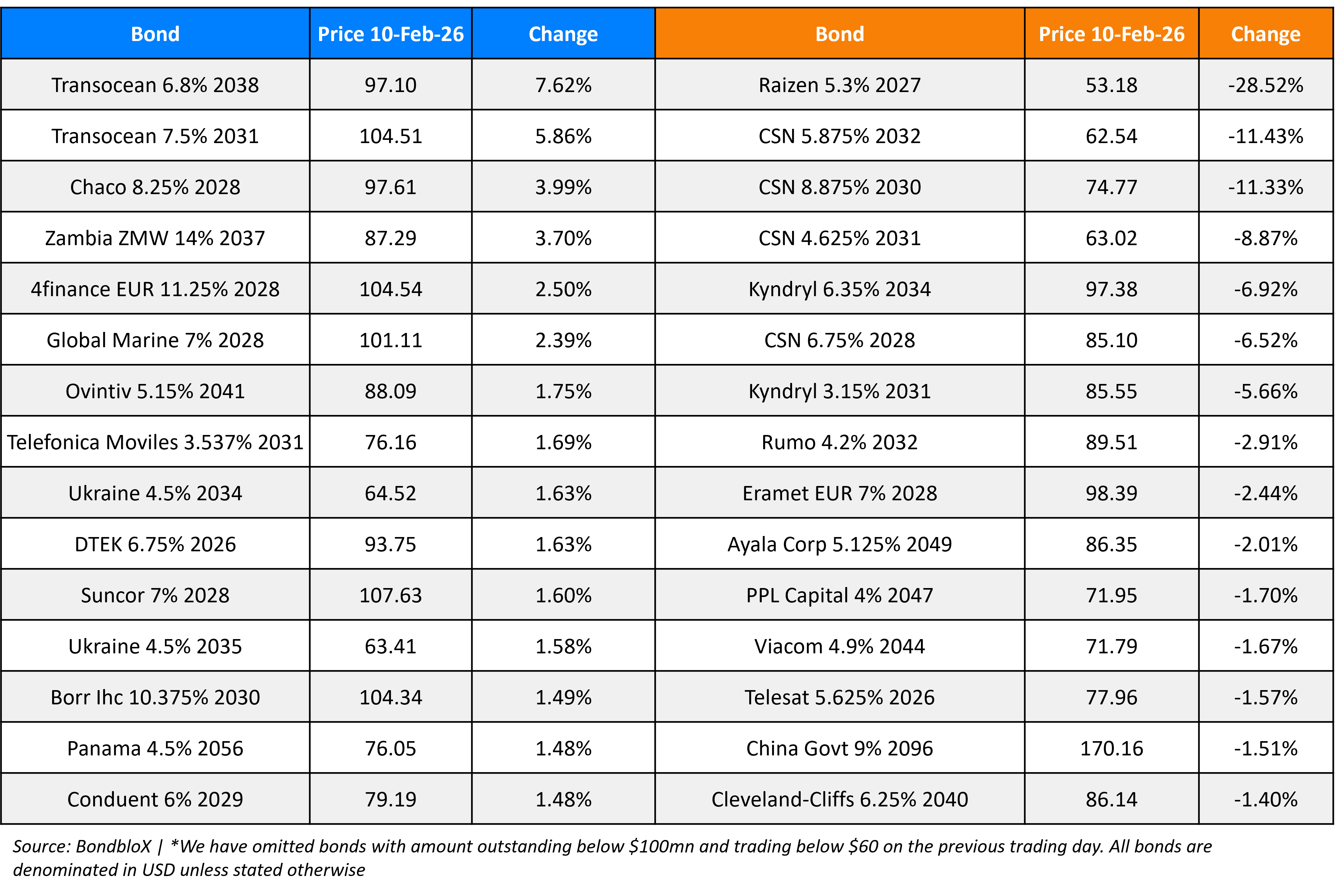

Top Gainers and Losers- 10-Feb-26*

Go back to Latest bond Market News

Related Posts: