This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Bocom Launches $ Bond

August 19, 2024

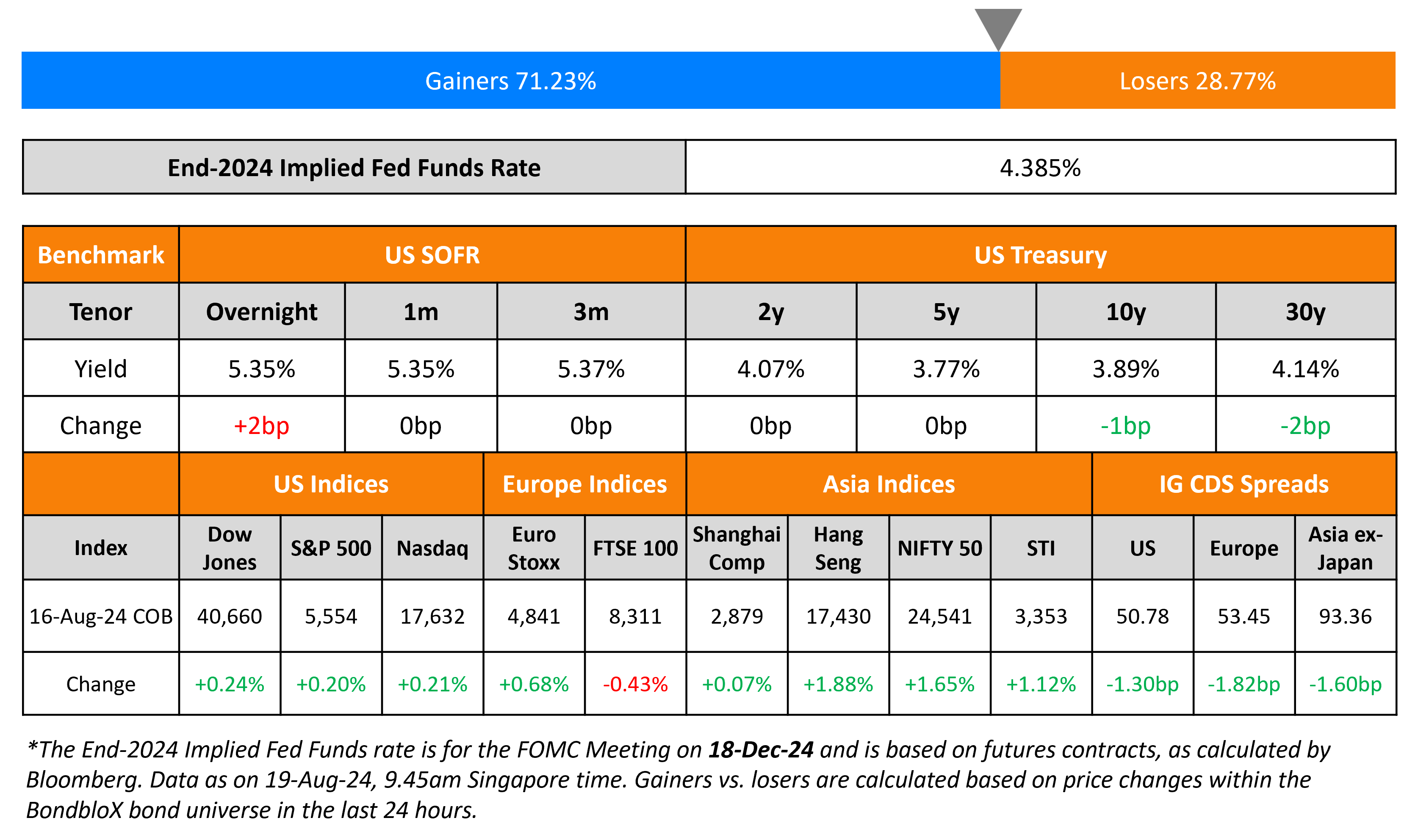

US Treasury yields held steady across the curve with no major data points or catalysts. Chicago President Austan Goolsbee said that the US economy was not showing signs of overheating and therefore the Fed should be wary of keeping monetary policy restrictive for longer than necessary. Separately, San Francisco Fed President Mary Daly voiced her support for gradual interest rate cuts on the back of mounting confidence that inflation is heading lower. Looking at US equities, S&P and Nasdaq moved higher by 0.2% each. US IG CDS spreads tightened by 1.3bp while HY CDS spreads widened by 0.3bp.

European equity markets ended mixed. Looking at Europe’s CDS spreads, the iTraxx Main spreads tightened 1.8bp while Crossover spreads were tighter by 6.6bp. Asian equity indices have opened broadly higher today morning. Asia ex-Japan CDS spreads were tighter by 1.6bp.

New Bond Issues

- Bocom Financial $ 3Y Green FRN/3Y Green Fixed at SOFR+125bp/T+105bps area

Rating Changes

- Uber Technologies Inc. Upgraded To ‘BBB-‘ From ‘BB+’ On Improved Margin, Cash Flow; Outlook Positive

- Intel Corp. Rating Lowered To ‘BBB+’ On Weaker Near-Term Growth Prospects And Margin Compression; Outlook Negative

Term of the Day

Payment-In-Kind Bonds

Payment-in-kind (PIK) is a type of bond for which, on each coupon payment date, the accrued coupon is capitalized and fully or partially paid in the form of additional bonds or added to the principal amount. PIK bonds are typically bonds with deferred coupons. These are riskier for investors due to more credit risk with respect to the PIK interest amount, payment of which can be deferred until maturity. Given this inherent higher risk, interest rates for PIK bonds are higher than for conventional bonds. Generally, issuers with liquidity stresses that are able to pay coupons in non-cash form issue these notes.

As per Bloomberg, the mentioning of PIK in company filings/presentations/transcripts have doubled since the start of the pandemic, raising concerns among ratings agencies and fund managers.

Talking Heads

On Fed Facing New Risks as It Navigates Both Inflation and Jobs

Derek Tang, LH Meyer/Monetary Policy Analytics

“They are thinking not about the first two rate cuts but the whole strategy over the next 6-9 months”

David Wilcox, Bloomberg Economics

“FOMC has deliberately been slowing the pace of growth to let off the excess pressure in the economy”

On UK Economy Heading for Slowdown After ‘Goldilocks’ H1

Ellie Henderson, Investec

“The economic data released this week portrayed a somewhat Goldilocks scenario for the UK”

Thomas Pugh, RSM UK

“We think the UK economy has now firmly exited the stagnation phase… The risk is that if growth continues at this pace for the rest of the year we end up dipping into the too hot bowl”

Ashley Webb, Capital Economics

“The bigger picture here is it does feel like some of the recent momentum in GDP growth is easing”

On Targeting Latin America Rising Stars, Shunning China Debt – DoubleLine

“We had just started taking off some of the lower quality and moving it into higher quality,… expectation is that we potentially could have one more rating agency upgrade within the next 12 months or so… We didn’t need to be there (on China debt). We could find value to replace that elsewhere”

Top Gainers & Losers-19-August-24*

Go back to Latest bond Market News

Related Posts: