This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

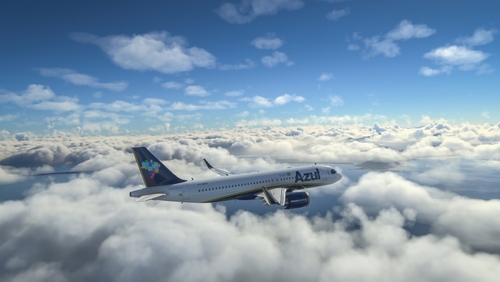

Azul Downgraded to CCC+ by S&P

September 3, 2024

Azul was downgraded by a notch to CCC+ from B- by S&P. The rating agency also downgraded Azul’s senior unsecured notes by a notch to CCC-. The downgrade comes after the company reported weak Q2 results, leading to weakening liquidity and a widening of free operating cash flow deficit for the year. As of end June, the company’s cash balance stood at BRL 1.5bn ($0.3bn), vs. operating leases and capital expenditure requirements totaling to BRL 5bn ($0.9bn) per year in 2024 and 2025, according to S&P. Last week, the company had denied any plans on filing for Chapter 11 bankruptcy protection.

Azul’s dollar bonds traded stable with its 7.25% 2026 at 83.5, yielding 18.53%.

Go back to Latest bond Market News

Related Posts:

Azul plans to Buy 100% of LATAM Airlines

November 3, 2021

Gol-Azul Announce Codeshare Agreement

May 27, 2024

Azul Denies Chapter 11 Plans

August 30, 2024