This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ares Said to Show Interest in Buying NWD’s Debt From Banks

March 13, 2025

Ares Management Corp is said to have recently approached at least two banks to acquire debts from New World Development (NWD) at a discount, as per source. The specific discount or amount thereof were not available. The potential move is considered part of Ares’ strategy to participate in NWD’s ongoing refinancing efforts. However, sources noted that the two banks did not show interest in engaging with Ares, and the current status of these discussions remains unclear. Private credit firms like Ares, have been targeting distressed assets in Hong Kong’s property sector as reports have indicated that banks are increasingly reluctant to extend credit. Ares had previously attempted to acquire a stake in a HKD 10.2bn ($1.3bn) loan for ‘The Corniche’ luxury properties but was unsuccessful. NWD is know to have among the highest debt burdens in the sector, with HKD 58.1bn ($7.5bn) in unsecured loans due in 2025 and 2026. It is currently trying to refinance some of its debt by offering $3.8bn in additional properties as collateral for loans maturing in 2027 and beyond.

For more details, click here

Go back to Latest bond Market News

Related Posts:

NWD Completes $4.5bn in Loans, Repayments YTD

June 25, 2024

NWD Warns of First Annual Loss in Two Decades

September 2, 2024

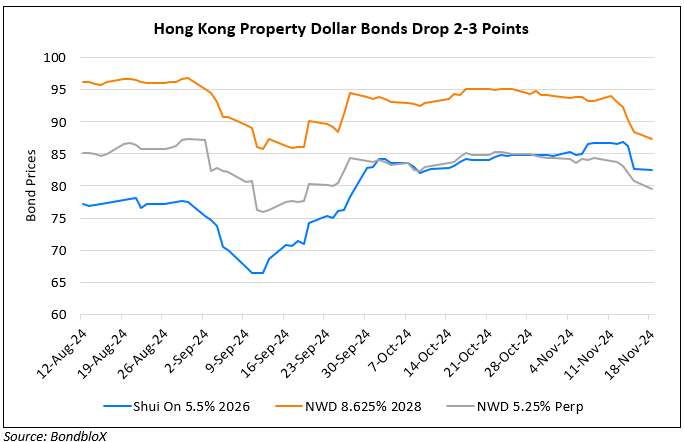

Dollar Bonds of NWD, Shui On Drop Sharply

November 18, 2024