This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

African Sovereign Bonds Trade Weaker Amid Uncertainty on Venezuelan Output

January 9, 2026

Dollar bonds of African sovereigns including Egypt, Nigeria, Angola and Kenya were trading weaker by 0.5-1 point on Thursday. A Bloomberg index noted that the 20 worst-performing EM sovereign dollar bonds were all from Africa. Analysts said that the move likely came on the back of the US signaling long-term plans to boost Venezuelan crude production, sparking fears of a global oil glut. This is said to have reduced the appeal of debt from oil exporters in the African continent, they added. For instance, a potential output boost from Venezuela could hurt Angola’s budget as oil accounts for 90% of its export earnings. Further, they noted that valuations of African sovereigns were already tight after an extended rally in late-2025.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Egypt Seeking $2.5bn Loan from Banks

August 12, 2022

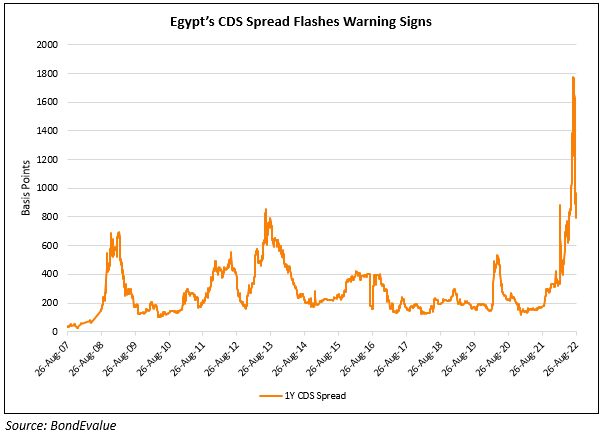

Egypt CDS Spreads Jump as Economic Health Worries Linger

August 29, 2022