This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

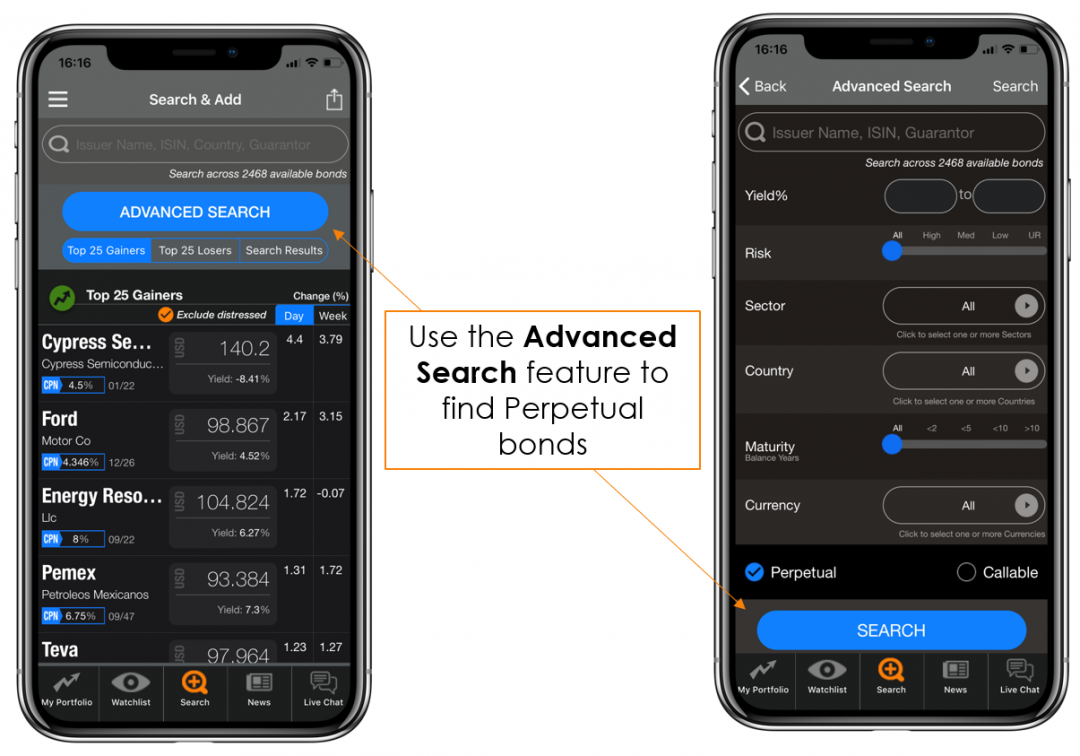

Perpetual Bonds – Understanding the Basics

What are perpetual bonds?

Perpetual bonds, also called perpetuals or perps, are fixed income securities that have no maturity date, or where the agreed-upon period of time over which interest will be paid is forever (in perpetuity). Unlike fixed tenor bonds that have a fixed maturity date and hence a predictable return of principal, perpetual bond do not have a fixed maturity date and hence no predictable return of principal. The only source of cash flow for perpetual bond investors is the scheduled coupon payments.

This makes perpetual bonds similar in nature to equity investments that pay dividends, rather than fixed-income or debt investments. Thus, perpetual bonds are often termed as hybrid investments as it has features of both debt and equity.

While most perpetual bonds do have a call feature, thereby allowing the issuer to redeem the perpetual bonds according to a fixed schedule, some perpetual bonds do not.

Why do investors buy perpetual bonds?

• Higher yield: Given the uncertainty with respect to return of principal, perpetual bonds tend to offer a higher coupon and hence a higher yield when compared to similar fixed maturity bonds. Thus, investors seeking higher yields flock to perpetual bonds.

• Coupon step-up: A coupon step-up feature in perpetual bonds enables the investor to receive an increase or step-up in the coupon rate as per a pre-set schedule. Coupon step-ups can be one-step or multi-step. One-step bonds have their coupon increased once throughout the bond’s lifetime. Multi-step bonds have multiple increases through their lifetime, as per a fixed schedule.

This feature compensates investors by reducing interest rate risk, particularly in a rising interest rate environment. At the same time, a step-up feature incentivizes issuers to call the bond before the step-up kicks in to avoid increased borrowing costs, allowing investors to take back their bond principal.

• Fixed-to-floating coupon: Some perpetuals have a feature whereby the coupon changes from a fixed rate to a floating rate during the lifetime of a bond. The floating rate is often quoted as a fixed spread over an index. Commonly used indexes include 3-month LIBOR and 3-month Mid Swaps rate.

This feature, once kicked-in, mitigates the interest rate risk for investors as their coupon payments are linked to a benchmark. This feature is particularly attractive for bond investors if interest rates are expected to increase in the future.

• Call feature: Most perpetual bonds have a call feature, thereby allowing the bond issuer to redeem the bond at a fixed date and price, as per the bond’s call schedule. For many of the perpetuals, the first call date is also the date of coupon reset (either step-up or fixed-to-floating).

When comparing two perpetual bonds, the bond with an earlier call date will have a shorter duration, all else remaining constant. Duration measures the interest rate sensitivity of a bond. “Generally, the higher a bond’s duration, the greater its sensitivity to interest rate changes. High duration bonds will fall in price by a greater magnitude as compared to lower duration bonds, if interest rates increase.”

The call date of a perpetual bond is a key factor that contributes to a perpetual bond’s duration. To understand this, we take two perpetual bonds issued by HSBC – both with a coupon of 6.375% but with different call dates. One perpetual bond has a call date of 17-Sep-24 has a lower duration than the perpetual with a later call date of 30-Mar-25. This is because investors stand to get back their principal at an earlier date if the issuer chooses to exercise the call option.

Why do issuers issue perpetual bonds?

• Fulfil funding needs: Similar to other debt or equity instruments, corporate perpetuals are issued by non-banking corporations to meeting their business funding requirements. Although the company would have to pay investors a yield premium for the perpetual nature of the bonds, it can potentially not have to repay the bond’s principal for many years or into perpetuity. An example of a corporate perpetual is General Electric’s 5% perpetual bonds.

• Meet regulatory capital requirements: Banks or related financial institutions who need to fulfil their capital requirements can do so with the issuance of hybrid securities including perpetuals. An example of a corporate perpetual is HSBC’s 6% perpetual bonds.

Get the latest news on bonds

Receive curated global bond market news directly in your inbox everyday to stay updated